- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

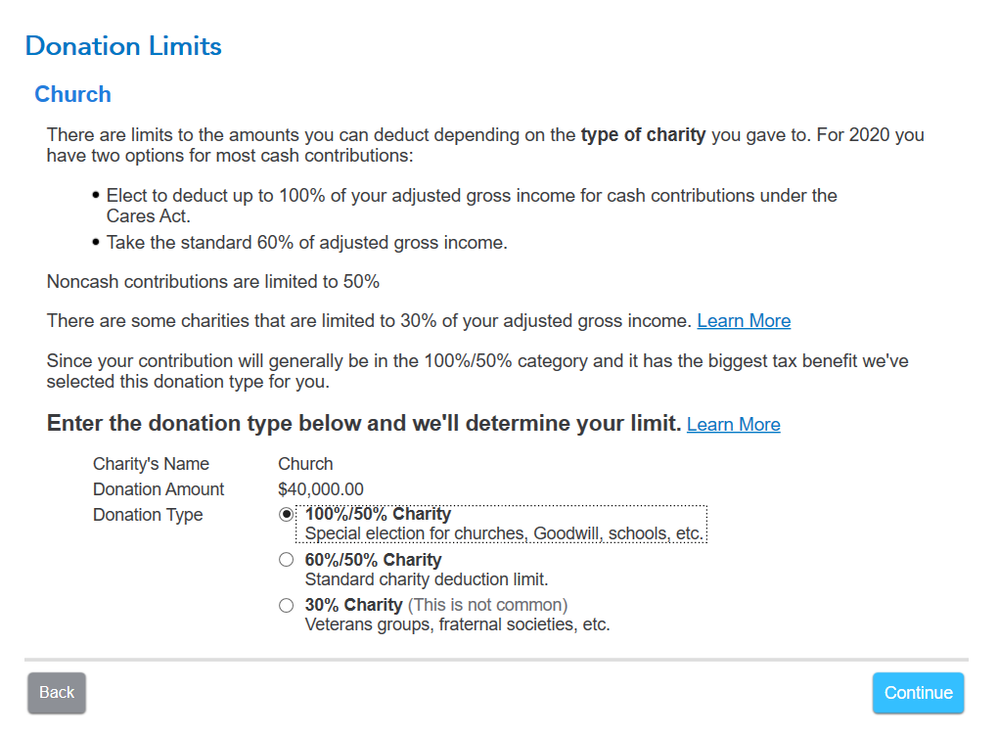

TurboTax makes the qualified contributions entry on Schedule A line 11 if you made cash donations exceeding 60% of your AGI and you select "100%/50% Charity" on the Donation Limits screen. See the screen shot below.

But if you filed your tax return without the election, your deduction on Schedule A line 14 would have been limited to 60% of your AGI and the IRS would not be telling you that you have to pay more tax. There must be something else going on that you haven't mentioned. Did the IRS notice make any other changes to your tax return, particularly anything that resulted in reducing your AGI? Did the IRS adjust your tax return for the unemployment exclusion? That adjustment would reduce your AGI.

What is the notice number or letter number, starting with CP or LTR, at the top right on the IRS notice?

Is the IRS notice for 2020 or for an earlier year?

Since you have already received an IRS notice, you will have to respond to the notice. You will not need to update Schedule A unless the IRS notice asks for a revised Schedule A or an amended return.