- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

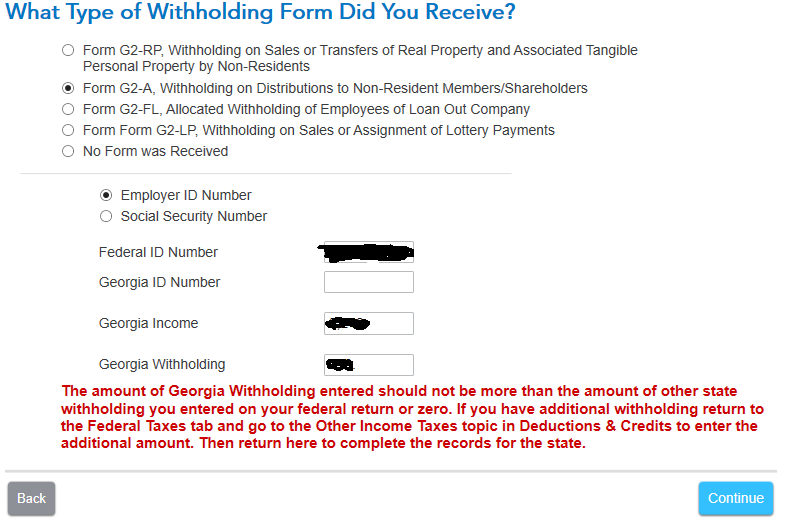

Hi, a partnership of mine made withholdings at more than 3 states. (It doesn't do composite.) Is there a better way to enter them than estimated tax payments? When you enter it as estimated tax payments, instead of a "Other Income Taxes", you can't put additional information. For example, see the screenshot below of the TT entry form for G2-A withholdings for Georgia I would like to be able to use instead of estimated tax payment, which just takes a dollar amount and a date (which I don't know as the partnership didn't tell me the date of withholding). I'm also afraid Georgia will reject my tax return since they won't be able to find a historic estimated tax payment from me (it came from the partnership instead). Treating the withholdings as estimated tax payments seem like a trick to get TT to calculate the correct tax rather actually filling the taxes correctly. Am I missing something?