- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Yes, you should fill in the EIN for the LLC in the Federal interview section. This will pull into your state return. If you only have one LLC, you will only do this for one entity.

When you prepare your state return, you will only select the entity that is a single-member LLC that is registered with the Secretary of State. You will then be prompted to complete the information to generate Form 568. This form will not be electronically filed. You will need to mail it in separately. Your personal state income tax return will be electronically filed though.

You will need to review your input in the state section of the program to confirm your entries for the business that is a single member LLC.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

- You will see the screen titled Status of your state returns. Select Edit to the right of California.

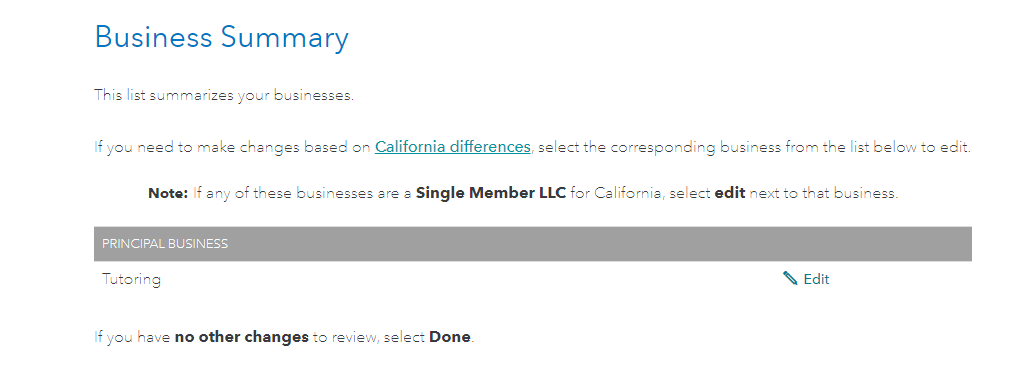

- Proceed through the screens until you see the state asking questions about your business. When you see the screen titled Business Summary, be sure to select Edit so you can correct the input here.

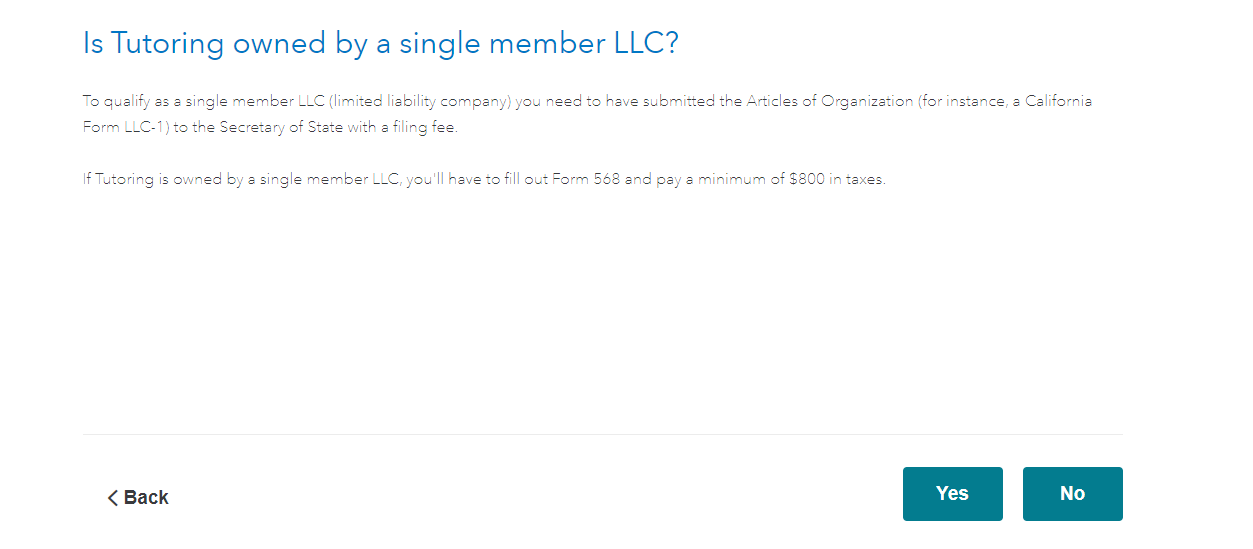

The following screen will ask you if your business is owned by a single member LLC?. Be sure to select Yes or No as applicable for each entity to property report the LLC classification on your state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"