- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The payments should be reported in Box 3 Other Income on the Form 1099-MISC. Schedule C is not required for these payments and they are not subject to self-employment tax.

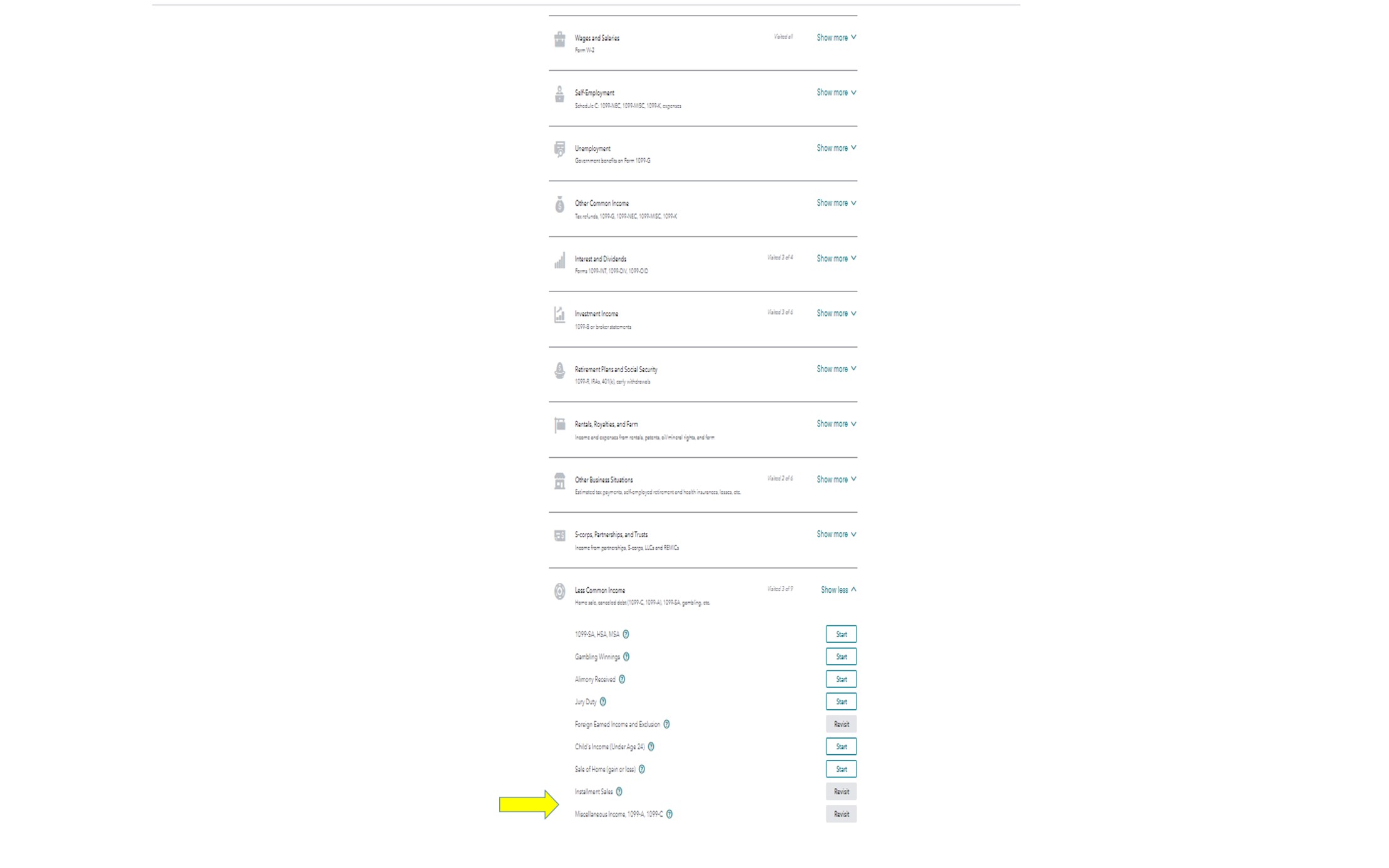

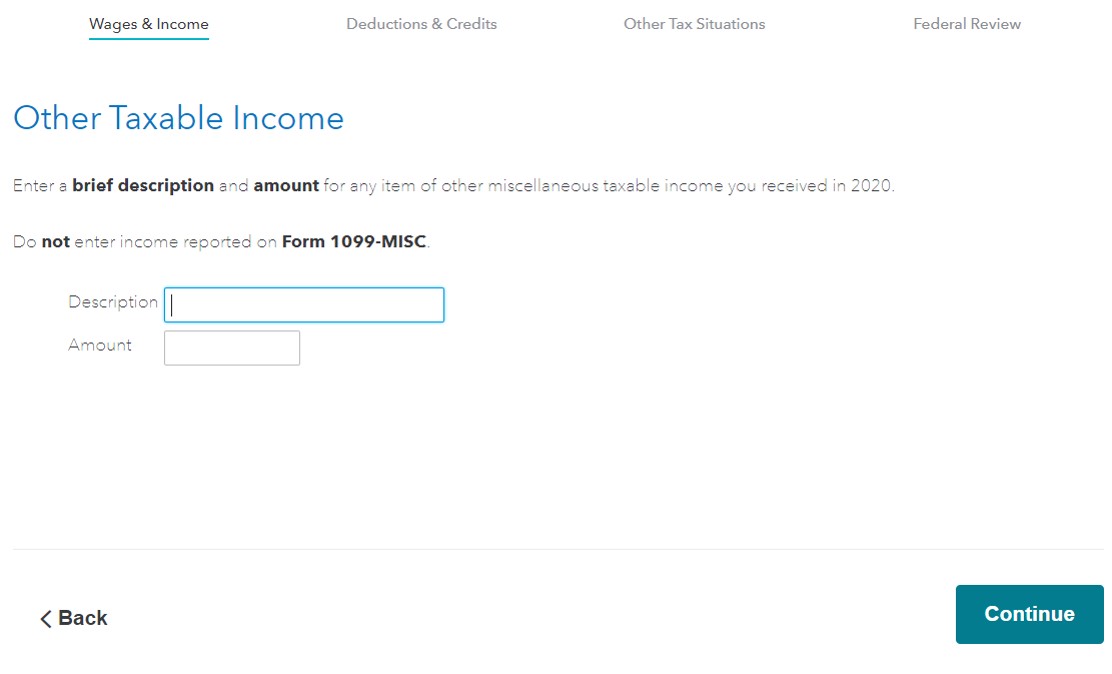

You can delete the 1099-MISC and report the income as Other Uncommon Income, Other Miscellaneous Income, Other Taxable Income.

March 21, 2021

3:02 PM