- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

@USAnyc1, I'm in the same boat as you (i.e., I also own units in Energy Transfer LP). As it relates to your question, as @nexchap stated above, "Even though a parent PTP owns the shares of the sub-PTPs on your behalf." In other words, yes, even though you don't directly own interest in the sub-PTPs/lower tier partnerships, my understanding is you need to enter separate K-1's for them, using the dedicated FEIN for each that appears on the "Supplemental K-1 Information Statement for Tax Year XXXX" page. One thing that was unclear to me is whether to use the same entity name for each (i.e., the name that appears on the actual Form 1065) or use the entity names that appear on the "Supplemental K-1 Information Statement for Tax Year XXXX" page. Can anybody speak to that?

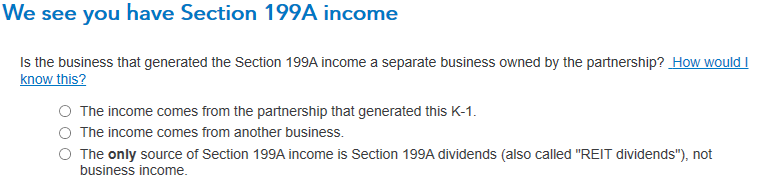

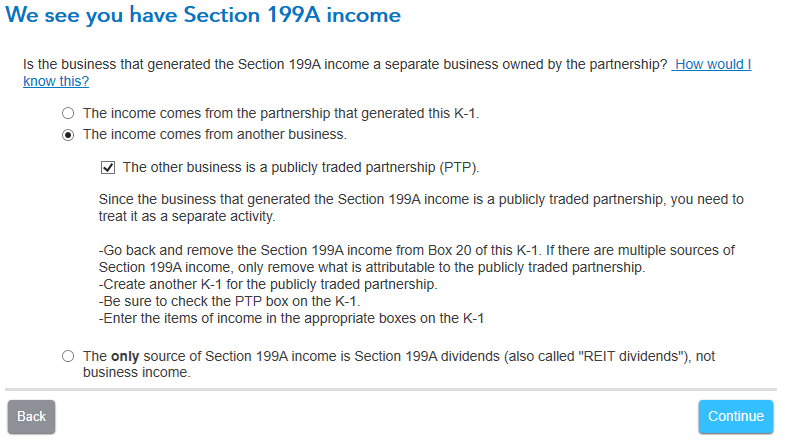

Also, see the first screenshot below from TT that appears when entering each K-1. For the K-1 for the parent company (i.e., Energy Transfer LP), I assume we select "The income comes from the partnership that generated this K-1" bullet. However, what about for the sub-PTP/lower tier partnerships? I thought we may need to select the "The income comes from another business" bullet, but if you do, then TT suggests going back and removing the 199A income from Box 20 and filing separate K-1's (as shown in the second screenshot below), which doesn't seem right, since that's already what I am doing. Can anybody clarify?