- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter income distribution deduction from trust in TurboTax Business for 1041 line18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Are you actually using TurboTax Business?

If so, you do not enter the deduction (IDD) itself; the program enters it for you based upon the amount you designated as having been distributed in the Distributions section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Hi Yes I am using the green package Turbotax Business for Trusts and Estates. I filled out the distribution section for the K-1 for the one shareholder at 37% distribution. Trust received $40,000 rental income, had $11,000 deductions and generated a K-1 for $10,715. This is the correct distribution. But the distribution does not show up on page one of the 1041 line 18 for income distribution deduction.I deleted the application and started over assuming I clicked something wrong but it came up the same the second time.

Thank you for responding so quickly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Yes there is the number after deductions from total income on line 9 which is correct, but nothing on line 10

I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Is the 1041 marked as a simple trust? Is there any figure on Line 7?

These anomalies are difficult to troubleshoot in this format so you might want to contact phone support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Did you ever figure out how to make an income distribution deduction come out on you 1041? I am having the same problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

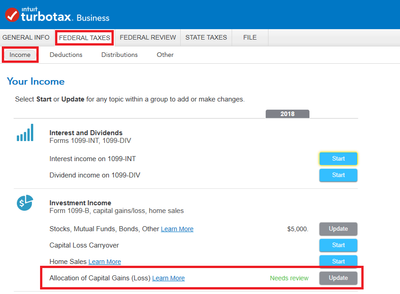

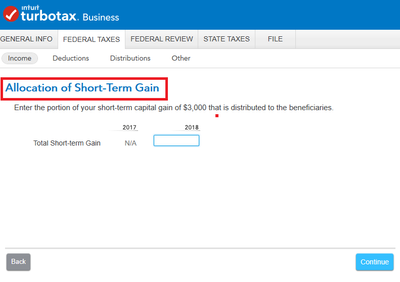

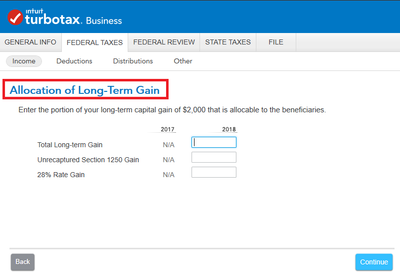

I've looked at all the deductions listed in the 1041 step-by-step and don't see anything that seems applicable. I have done the K-1s saying that the entire income (a LT capital gain) was distributed to the two beneficiaries. But on the 1041, it still has zero for the IDD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

@w-burnham wrote:

But on the 1041, it still has zero for the IDD.

You need to allocate the gain to the beneficiaries and also allocate the gain to income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

It worked! Thanks. But I still don't see a Sch B. Do I not need one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

I see it now. It's not a separate schedule, but a section of the 1041. Thanks!