- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The gross wage from the combined W-2 forms (using the W-3) is entered under the wages for Schedule C. Enter only your share (employer share) of payroll taxes under the taxes category.

- Under Wages and Income (or Business Tab) scroll to select the business where you want to enter wages

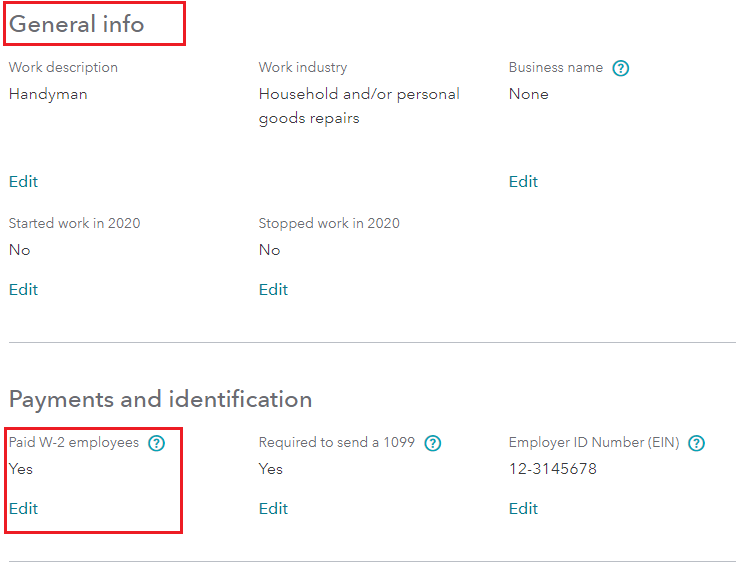

- First you will need to Edit General Info (Business Profile in Desktop) of your business - you must select 'Yes' you have employees

- Once this is completed the expense for Employee wages and work credits will appear under Common Expenses

This will allow you to continue to complete your Schedule C.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 8, 2021

6:05 AM