- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The code IC referred to in the response of DanielV01 is related to 2018 tax returns prepared in TurboTax. The K-1 entry has changed since 2018.

For 2019 tax returns prepared in TurboTax, a Form 1041 (Trust) Schedule K-1 uses box 14 code I ("India") to report Section 199A information.

Note that if the trust generated it's own Section 199A amounts and received Section 199A amounts from another entity (typically shown as "passthrough" on the Section 199A Statement), you will need to enter a second K-1 for that same trust. The first K-1 will report the box amounts for the trust, and the second K-1 for the trust will report the box amounts for the passthrough entity. The total for each of the boxes on the two K-1s must add to the total for that box on the K-1 you actually received from the trust. If you can't deduce these amounts from the information you have, you will need to contact the preparer of the K-1.

For 2019, when you enter your K-1 into TurboTax, on the screen with box 14 you enter your code I and code Z, but you don't need to enter any amounts on that screen. Continue on through the interview, and after a couple of screens asking about your qualified business income, you'll come to the screen "We need some information about your 199A income or loss" (see screenshot later in this post).

Your Section 199A Statement amounts will go on that screen. When you select a line on that screen, the boxes will "open up" to enter both your Section 199A amounts. Note that the "Unadjusted basis" number you have goes on the UBIA of qualified property line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

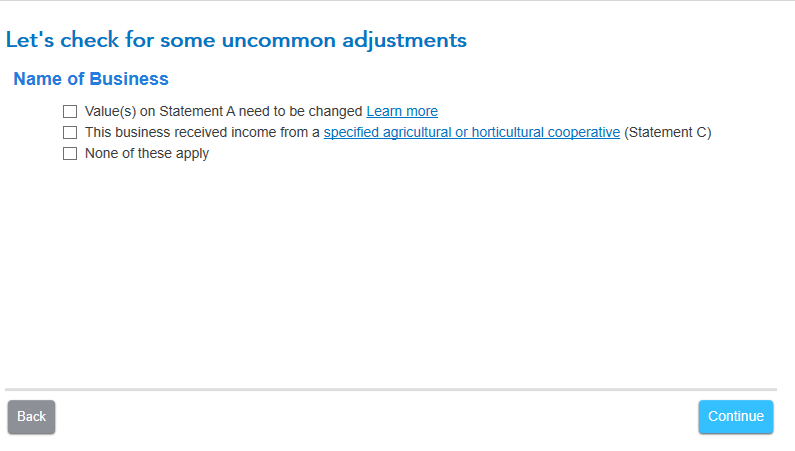

Here is the screenshot for the "We need some information about your 199A income or loss" screen (and the following "Let's check for some uncommon adjustments" screen where you enter the Section 199A Statement/STMT information from your K-1:

**Mark the post that answers your question by clicking on "Mark as Best Answer"