- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

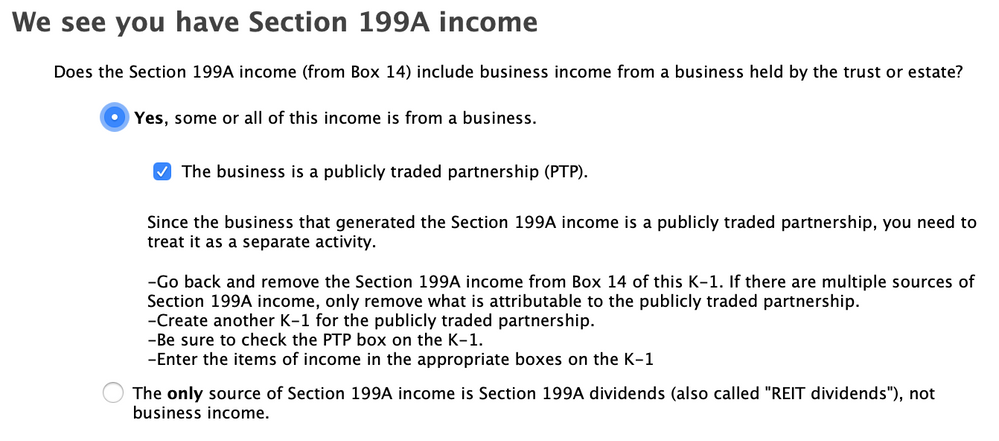

My experience indicates that you can add two separate entries in Box 14 with the code 'I'. But... if one is for 199A REIT dividends, and the other is for Qualified Publicly Traded Partnership (PTP) income, TT will tell you you need to remove the PTP income from the K-1 (along with the box 14 code I amount) and set up a separate K-1, selecting PTP for the second K-1.

If your K-1 is from a trust that holds an interest in the PTP, what I can't tell you is whether you should create a new trust K-1, using the trust's name and EIN, that only holds the PTP income and the qualified PTP income, or whether you should create a PTP K-1 as though you got it directly from the PTP.

July 6, 2020

5:54 PM