- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

That info is entered on the 1099-MISC entry screen.

- To quickly get to the 1099-MISC form screen, type 1099-MISC in the search bar and click on Jump to 1099-MISC in the results box.

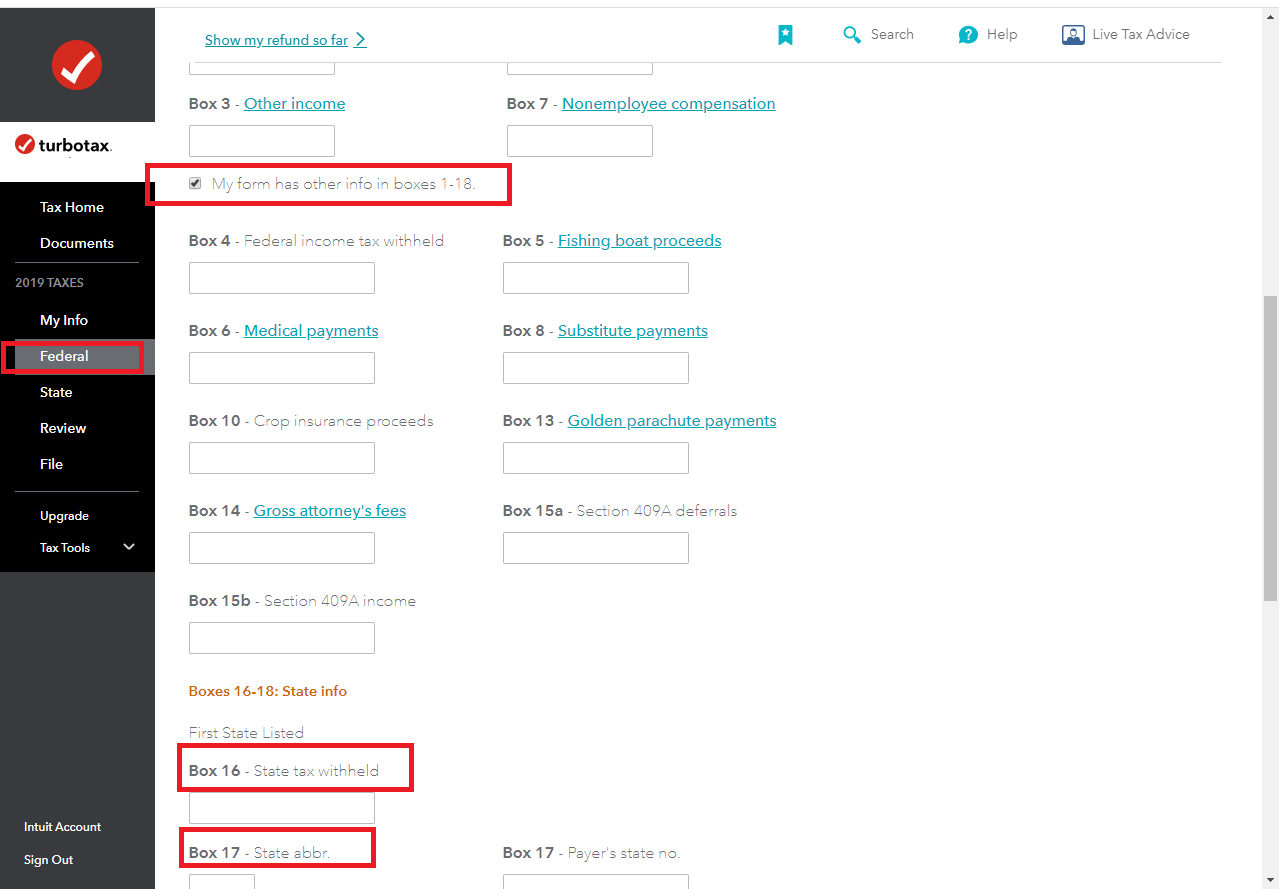

- On the Let's get the info from your 1099-MISC screen, scroll down to and check the box My Form has other info in boxes 1-18 (located under Box 3).

- Scroll down to Box 16 and enter the state income tax withheld.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 26, 2020

5:21 AM