- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

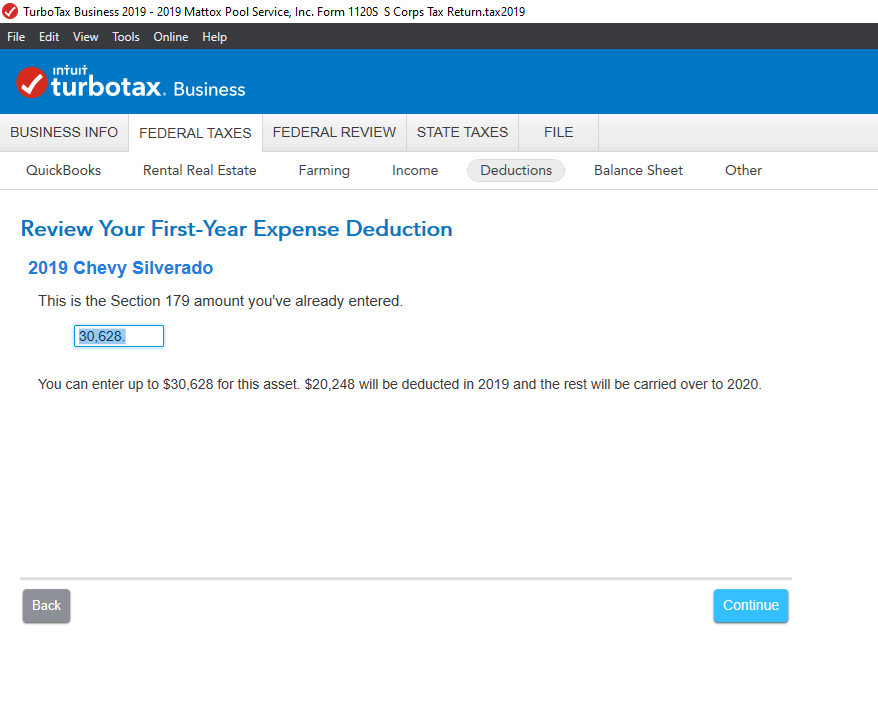

Thank you for your responses yesterday. They were very helpful. I now understand where TurboTax is calculating the 'Tentative Business Income' on Line 3A of the 1120S Depreciations Options form. However, I still have one question about whether a Section 179 depreciation expense can exceed the company's net income. See the attached screen shot where it appears that I should be able to depreciate only $20,248 (my net income) instead of the total cost of the asset $30,628. TurboTax is asking me this question but it is not showing up on Form 4562 or on the 1120S pages 1

January 22, 2020

11:30 AM