- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Line 18 of schedule D is used to report the sale of capital gain property that is taxed at a maximum rate of 28% on your federal tax return. That category of assets is reserved for collectibles and qualifying small business stock.

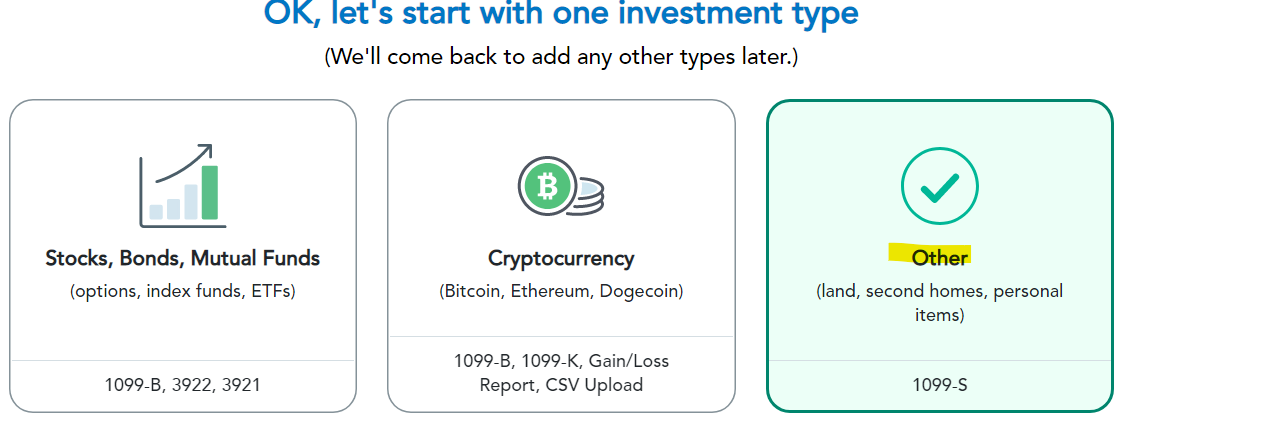

For collectibles, you would enter those in the Investment Income section, then Stocks, Cryptocurrency, Mutual Funds, Bonds and Other. Choose Other for the investment type.

On the screen where you enter the sale details, choose Collectibles from the drop down menu for What type of investment did you sell?

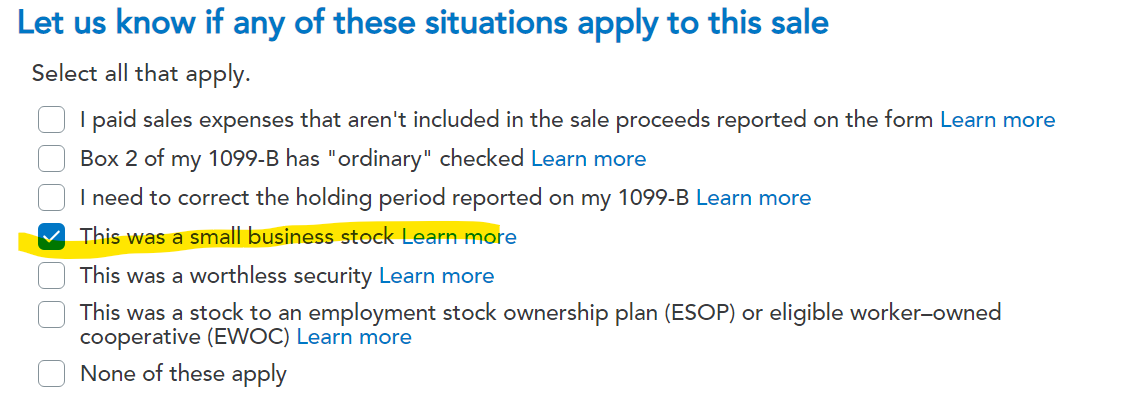

To enter the sale of small business stock, choose the Stocks, Bonds, Mutual Funds option for the investment type and after you enter your sales information you will see an option to indicate that your sale was of small business stock:

**Mark the post that answers your question by clicking on "Mark as Best Answer"