- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

That's correct. You would need to enter the adjustments on a later screen.

To verify your input, please follow these steps to get back to the 1098-T input screens.

Once you get back to the input screens, you would need to make the applicable adjustment under the section titled Scholarships/Grants (for all schools) on the page titled "Here's your Education Summary." Select edit to the right of Scholarships/Grants.

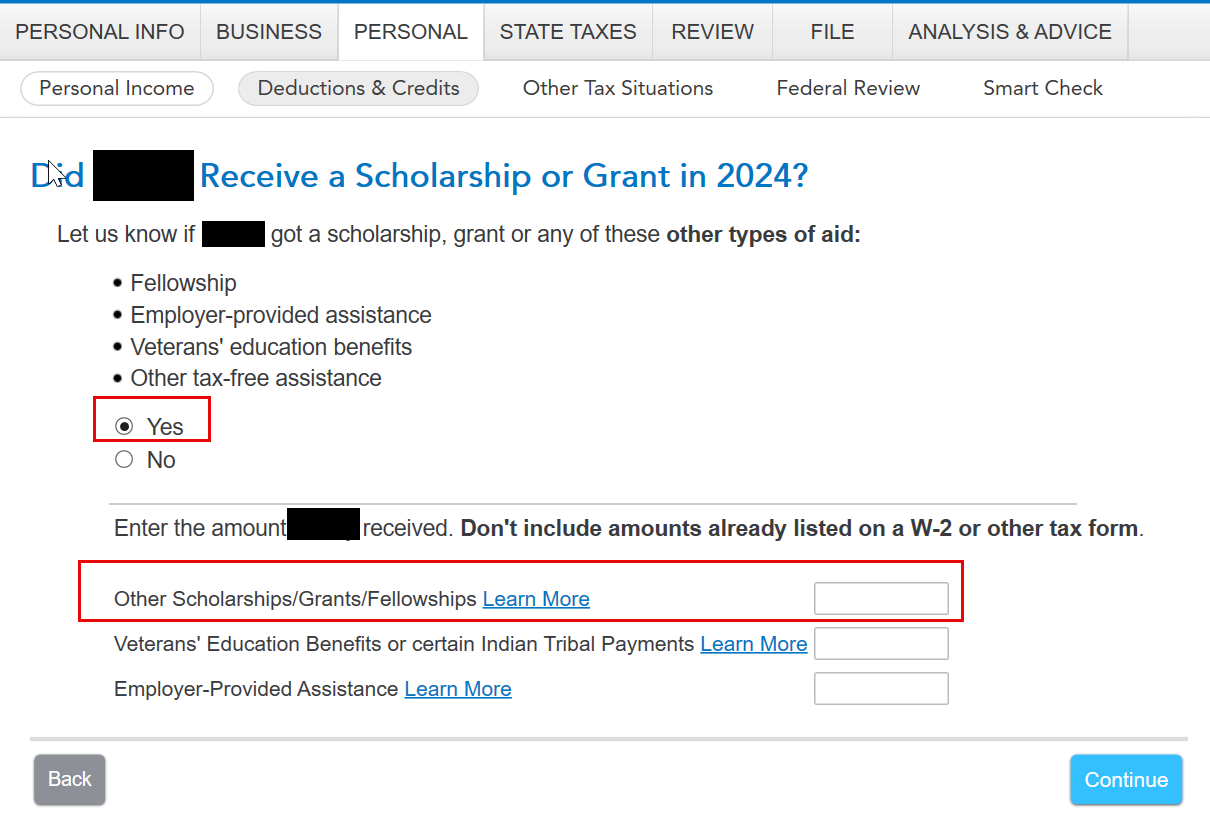

You will then be taken to a page titled "Did xx Receive a Scholarship or Grant in 2024?" Select Yes.

This will pull up a box where you can edit the scholarship amount that should be allocated to the 2024 tuition year even though it was received in 2025.

In 2025, you may have part of that scholarship amount listed on your 2025 Form 1098-T. If you do, you will need to manually adjust it so it's not included on your 2025 tax return since it would already be reported on your 2024 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"