- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Self-Emplohyed deductions using maximum allowable contribution

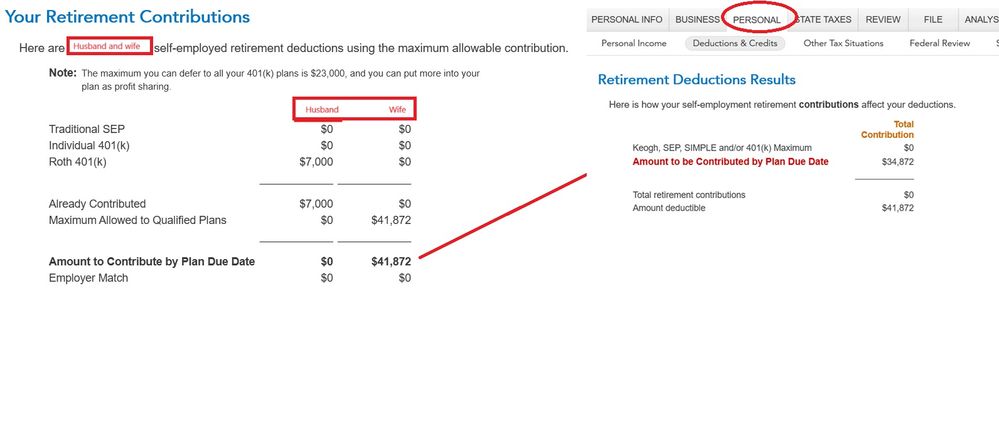

I'm using Home & Bussiness version. I'm a full-time employee while my wife is a full time realtor as self-employed. We would like to maximum the allowable contribution. When I was in bussiness section of retirement deductions and selected Maximum allowable, it tells me that my wife can contribute up to 41,872. However, the amount was reduced to $34,872 when moving to personal section under Deductions&Credit. So my guess is the total 41872 - 7000=34,872 my contribution to Roth (IRA)? So which amount should my wife should contribue by the due date? Please see the captured screen. How it comes up with $41,872?

Thanks

Topics:

April 15, 2025

8:27 AM