- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you’re an actor, musician, or other type of performing artist, you can deduct unreimbursed job-related expenses if you satisfy all of the following requirements:

- You were employed as a performing artist by at least two employers during the tax year.

- You received wages of $200 or more per employer from at least two of those employers.

- You had allowable work-related expenses connected to the performing arts that’s more than 10% of your gross income from the performing arts.

- Your AGI is $16,000 or less before deducting work-related expenses.

If you’re married, you must file a joint return to deduct job-related expenses, unless you didn’t live with your spouse at any point during the tax year.

The miscellaneous itemized deduction for unreimbursed employee expenses was suspended from 2018 to 2025 by the Tax Cuts and Jobs Act of 2017. However, reservists, performing artists, fee-basis government, disabled workers with impairment-related work expenses, and educators can still deduct certain job-related expenses that aren’t reimbursed.

These expenses are reported on Form 2106.

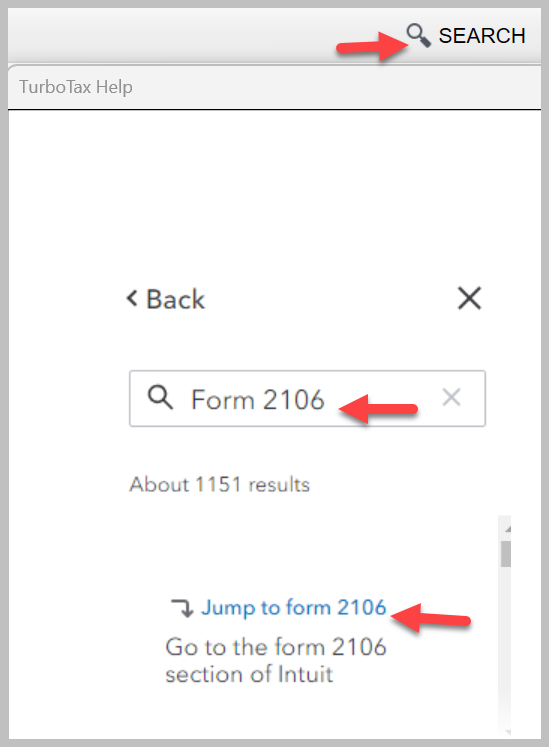

To enter these expenses in TurboTax you can:

- Click on the search icon in the upper right of your TurboTax screen

- Type "Form 2106" in the search bar

- Click on the link "Jump to Form 2106"

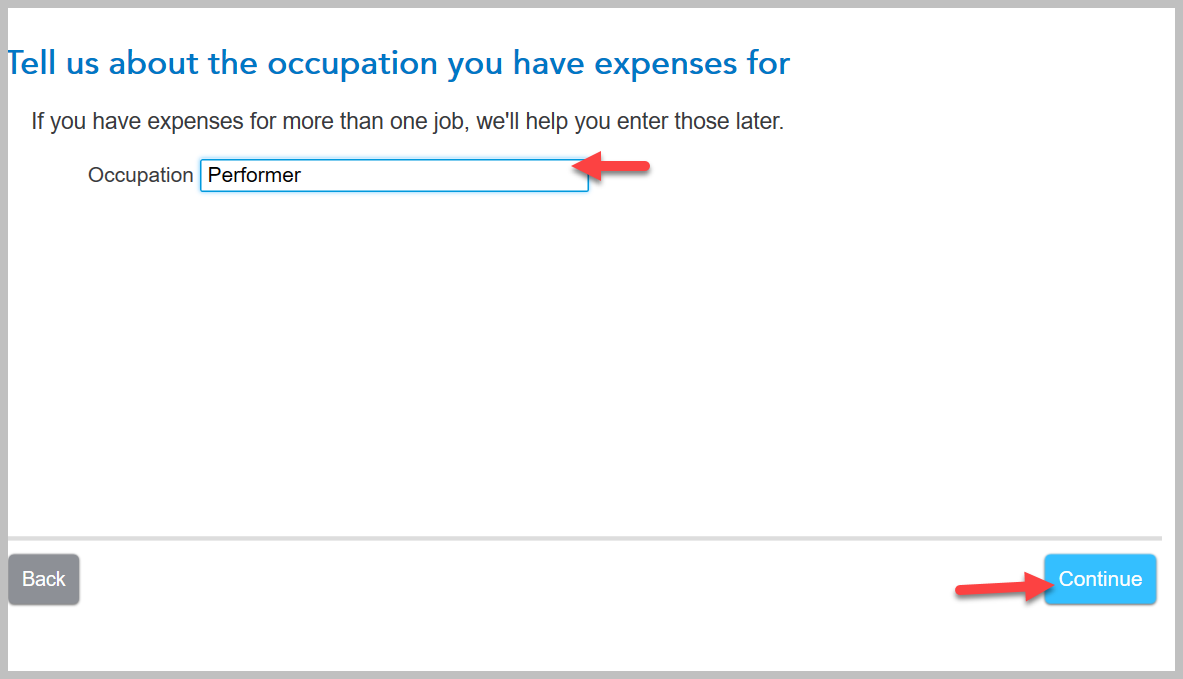

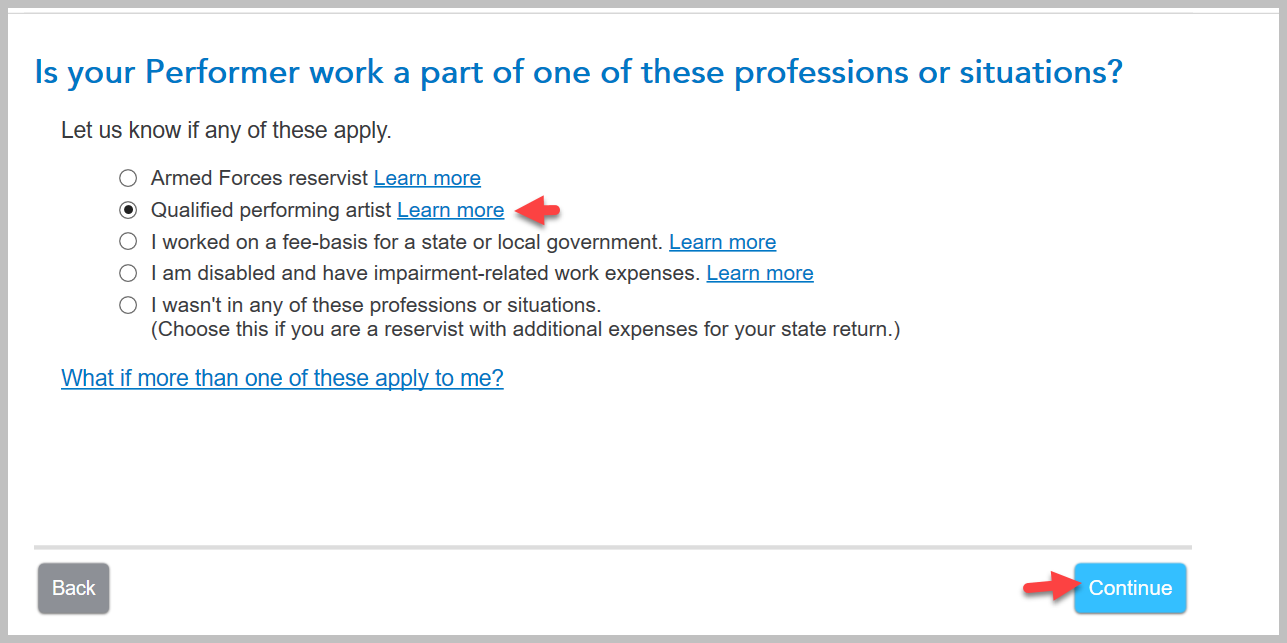

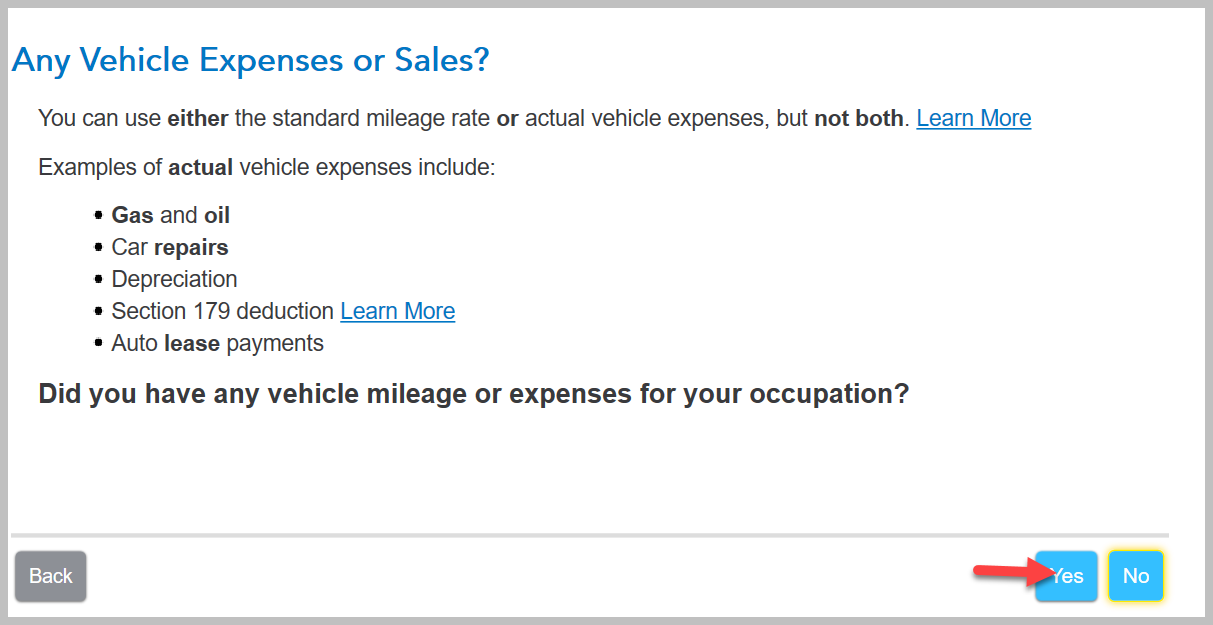

- Follow the TurboTax screens to enter your expenses

- Answer all follow-up questions

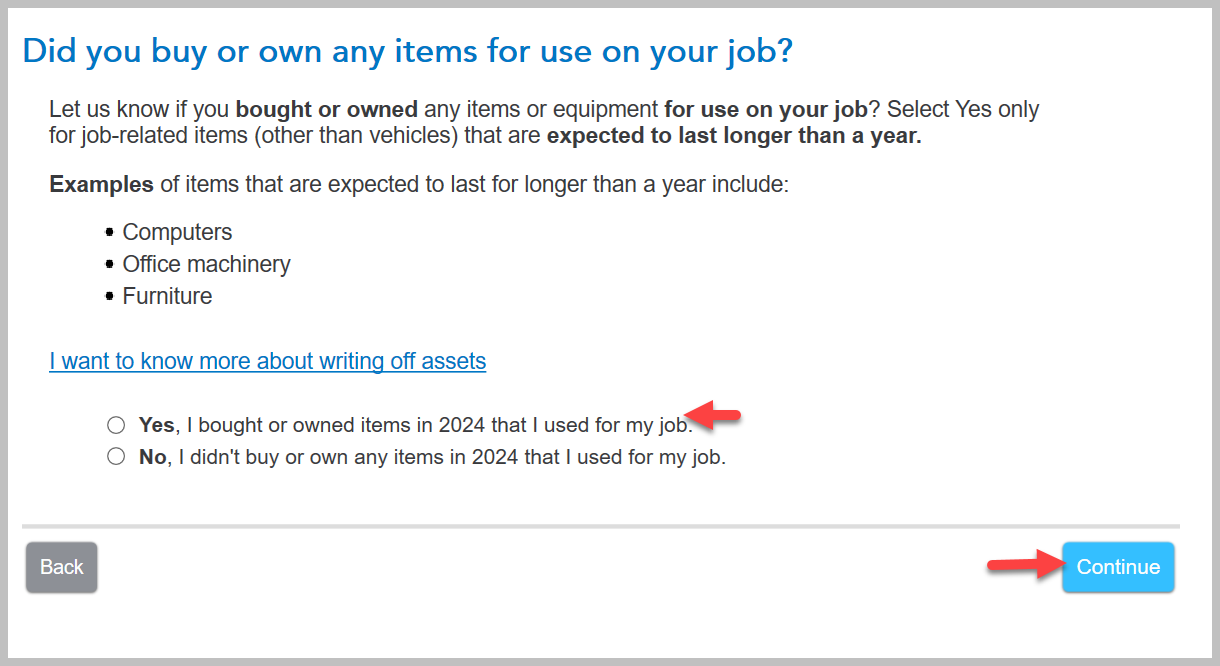

Your TurboTax screens will look something like this:

Click here for Are Unreimbursed Employee Expenses Deductible?

**Mark the post that answers your question by clicking on "Mark as Best Answer"