- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Review your personal info to ensure that you have:

- Entered your child as a dependent

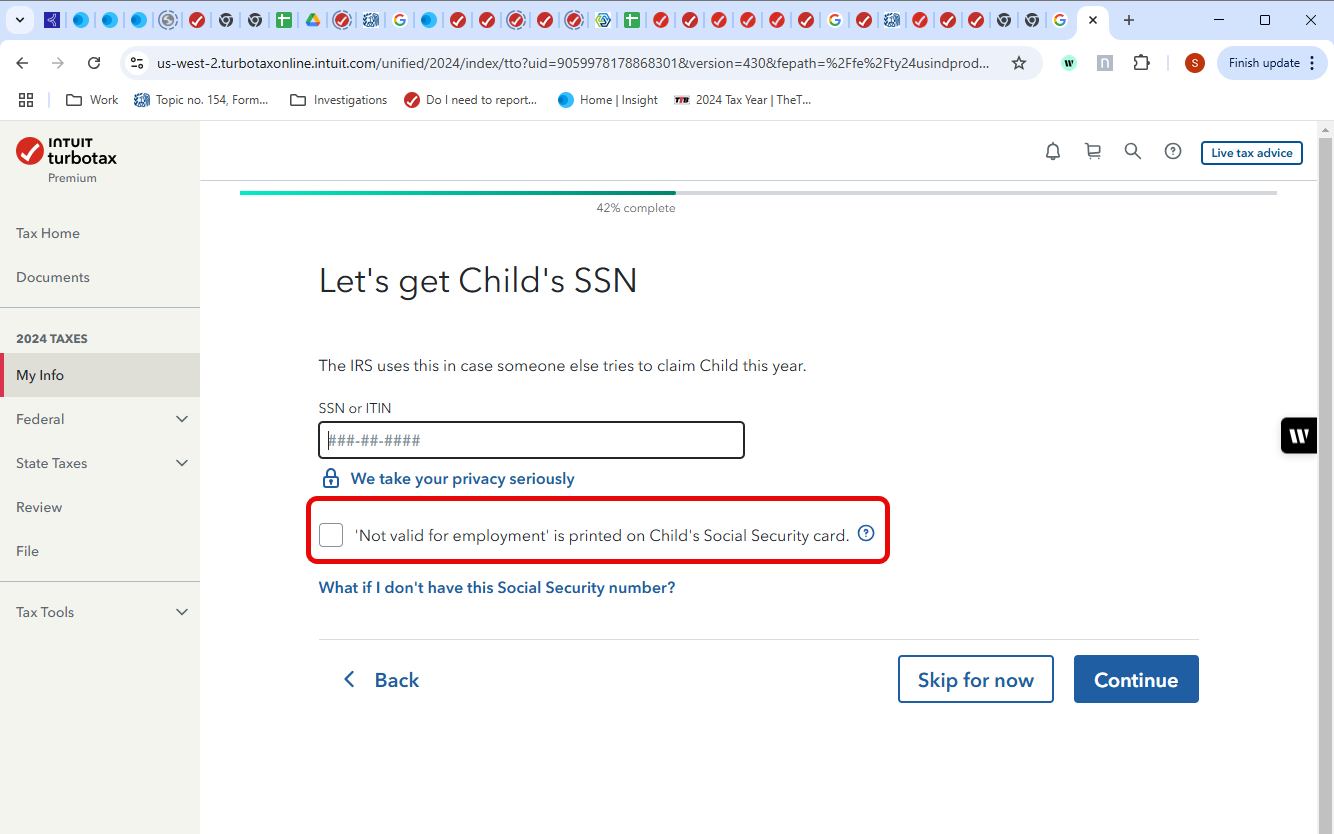

- Entered your child's Social Security number

- You didn’t enter that your child’s SSN is not valid for employment.

To edit your dependent in TurboTax:

For TurboTax Online:

- Go to the Personal profile screen

- Under Your Household, select Revisit. Go through the interview screens and make sure that you check Yes your child lived with you for the whole year.

For TurboTax Desktop:

- Open your tax return

- Select Personal Info

- Select Edit next to your dependent.

Make sure the box isn't check next to Not valid for employment' is printed on Child's Social Security card.

For more information, review the TurboTax Help article Child Tax Credit and What is the IRS Form 8812?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 13, 2025

1:39 PM