- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

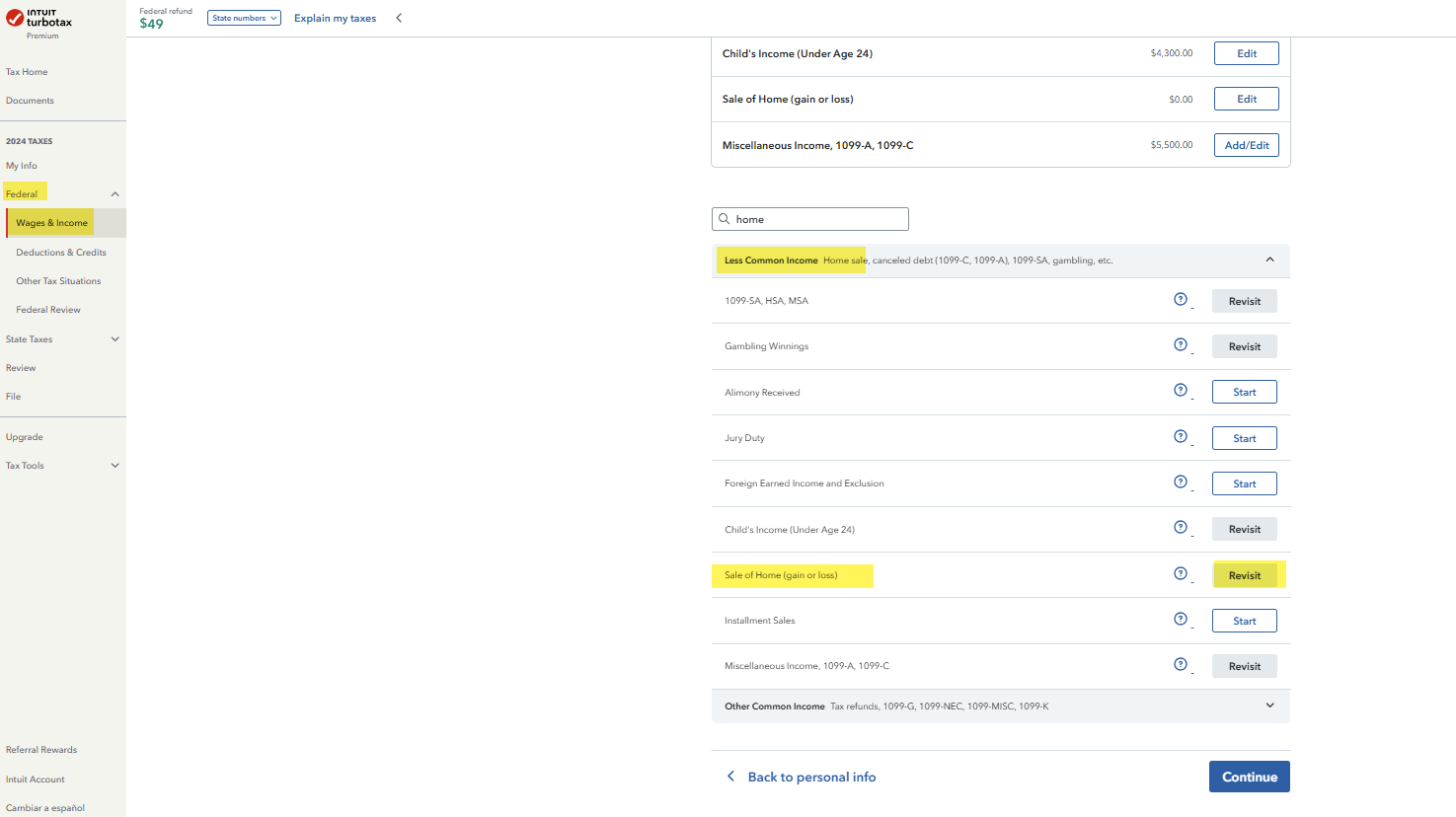

In order to report the sale of your house (not rental property), navigate to Federal > Wages & Income > Less Common Income > Sale of Home (gain or loss) > Start or Revisit. Continue through the interview to enter proceeds from the 1099-S and details about the home.

Note: If you meet the primary residence exclusion (lived in the home for at least 2 years out of the last 5 and gain of less than $250,000 for a single or $500,000 for a couple filing jointly) and you did not receive a 1099-S, you don't need to report this.

Here is some more information you may find helpful: Tax Aspects of Home Ownership: Selling a Home

April 9, 2025

7:14 PM