- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you itemize your deductions, you may be able to claim your margin interest as an investment expense on your Form Schedule A. Your investment interest expense deduction is limited to your net investment income.

Taking the standard deduction prevents you from claiming margin interest on your taxes.

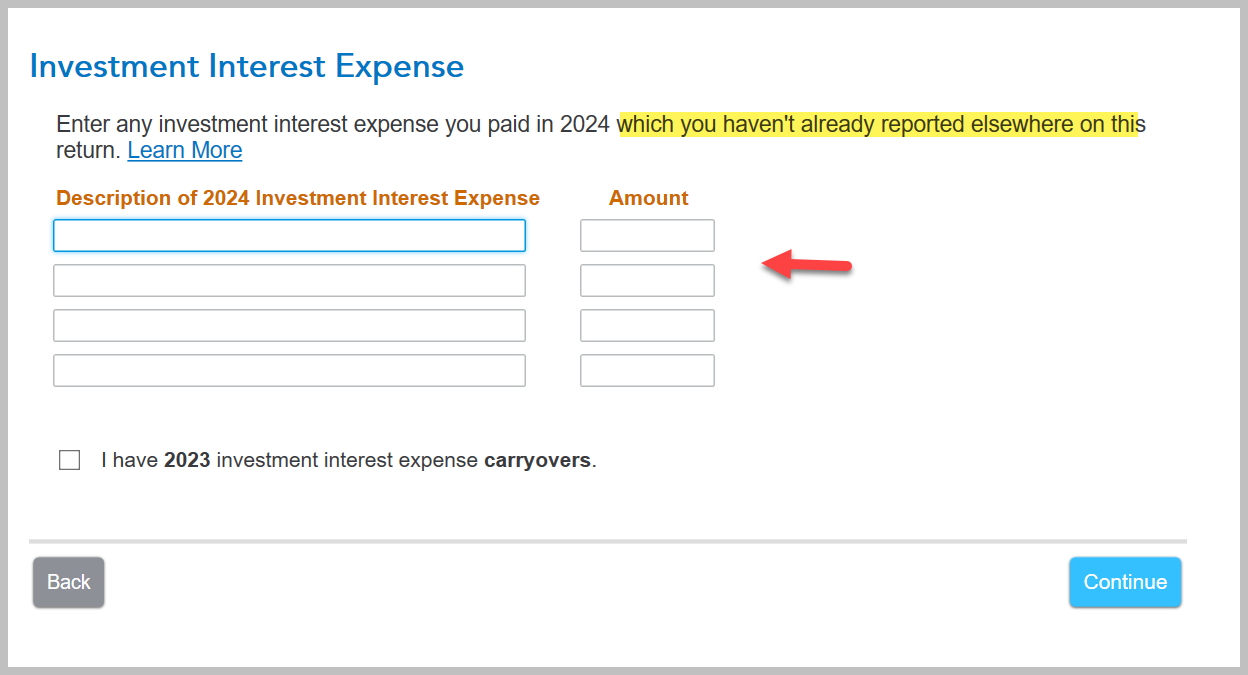

You would claim a deduction for Investment (margin) interest deduction on Form 4952 Investment Interest Expense Deduction and the allowable deduction will flow to Schedule A (Form 1040) Itemized Deductions, Line 9 to be claimed as an itemized deduction, up to the amount of your investment income. TurboTax will complete this form for you.

You can enter your investment interest in TurboTax as follows:

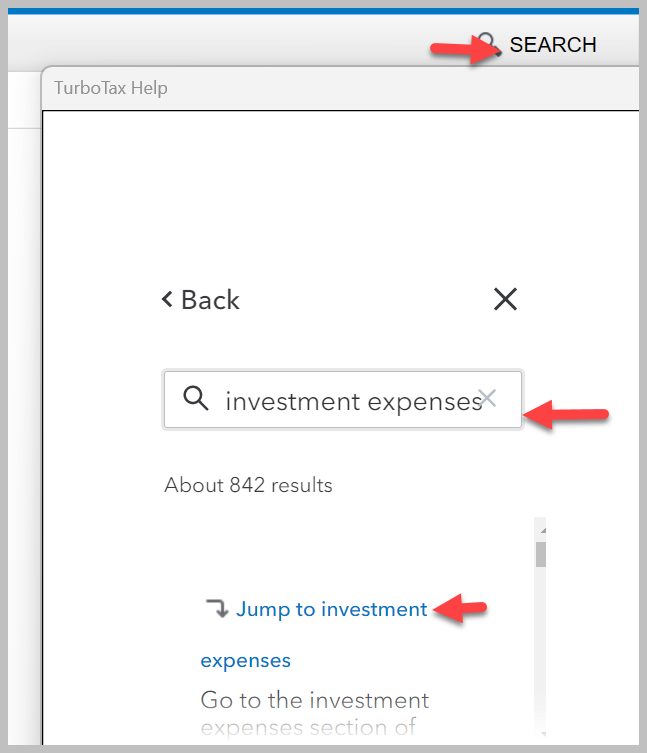

- Click on the search icon in the upper right of your TurboTax screen

- Type "investment expense" in the search bar and hit enter

- Click on the link "Jump to investment expenses"

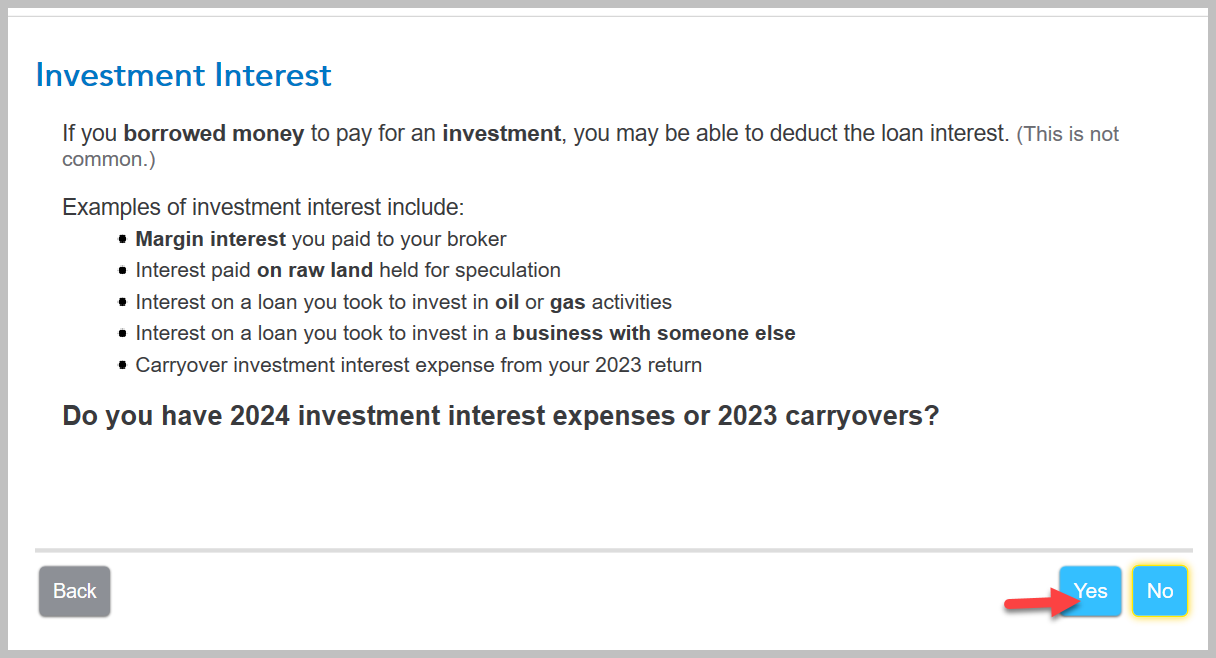

- Follow the TurboTax screens and answer all follow-up questions

Your TurboTax screens will look something like this:

Click here for What is Form 4952: Investment Interest Expense Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"