- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You can go back through your TurboTax screens regarding your HSA to make sure that you answered them accurately.

If you have an excess on your 2024 return, you can tell TurboTax that you will withdraw it by April 15, 2025. You will have to contact your HSA provider to make the withdrawal on time.

If your HSA is overfunded, you will indicate this on the TurboTax Screen that says, "You may want to withdraw money from your HSA".

You can select the option "Ok. I'll Withdraw $XXX excess contribution by April 15, 2025".

You will see the total amount of your excess contributions for the year on IRS Form 8889, Health Savings Accounts (HSAs). This amount would be taxable income.

All excess contributions are subject to income tax and a 6% excise tax each year until corrected.

To revisit your HSA screen in TurboTax to make sure your excess HSA contribution was not due to an entry error, you can:

- Click on the search icon in the upper right corner of your TurboTax screen

- Type "HSA" in the search box

- Click on the link "Jump to HSA"

- Answer the questions until you get to the screen "Let's enter your HSA Contribution"

- Make sure you did not accidently enter an amount on this screen that was already reported in Box 12 of your Form W-2. This will double your total contribution amount.

- Continue through your TurboTax screens and make sure all questions were correctly answered.

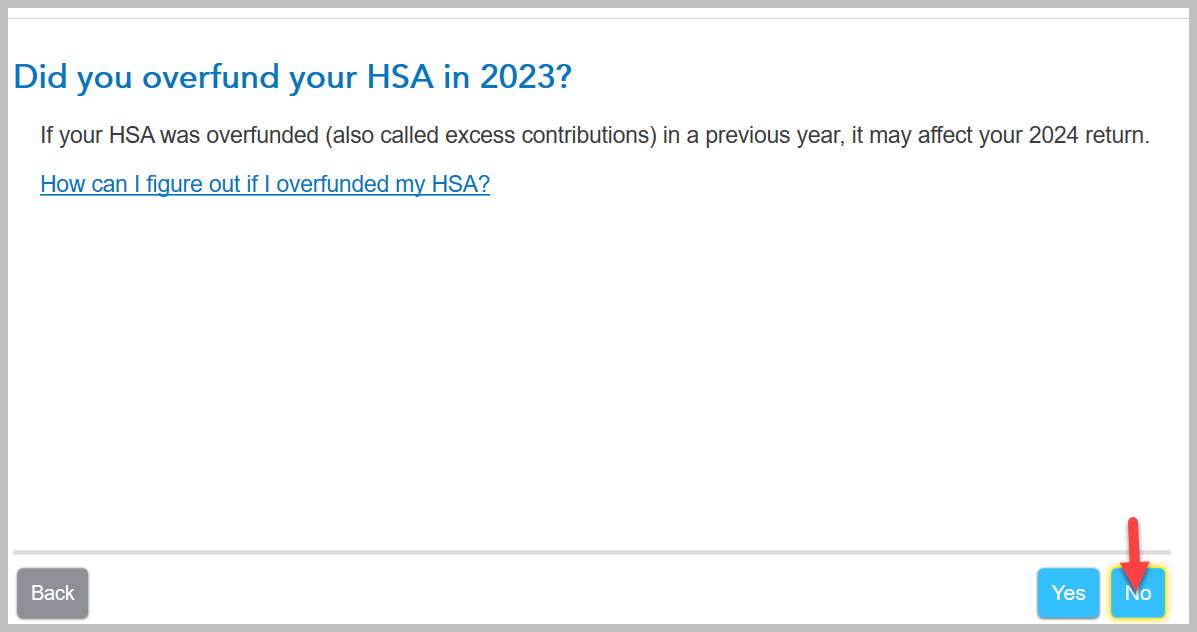

- As per the above, if you removed the excess contribution from 2023 or did not have one answer "No" to "Did you overfund your HSA in 2023?"

Your screens will look something like this:

Click here for "Why am I showing an excess HSA contribution?"

Click here for "What is a health savings account (HSA)?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"