- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You can enter your electric vehicle charger expense in TurboTax as follows:

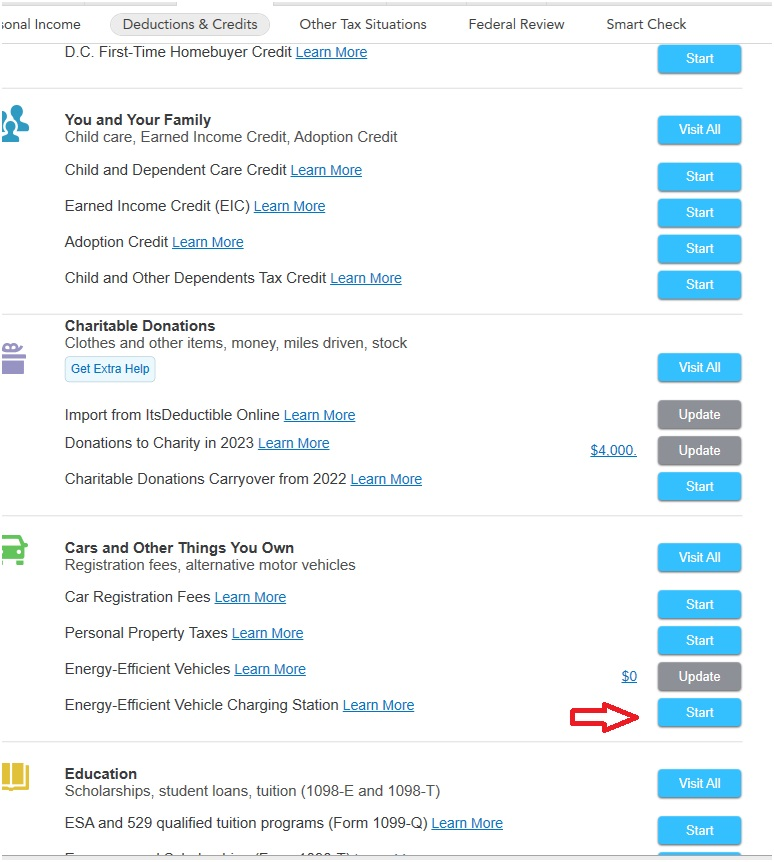

If you are using TurboTax Desktop:

- Select the "Deductions & Credits" tab at the top of the screen.

- Select " "

- Scroll down to "Cars and Other Things You Own".

- Select "Energy-Efficient Vehicle Charging Station", "Start/Revisit".

- Continue with the on-screen prompts until complete.

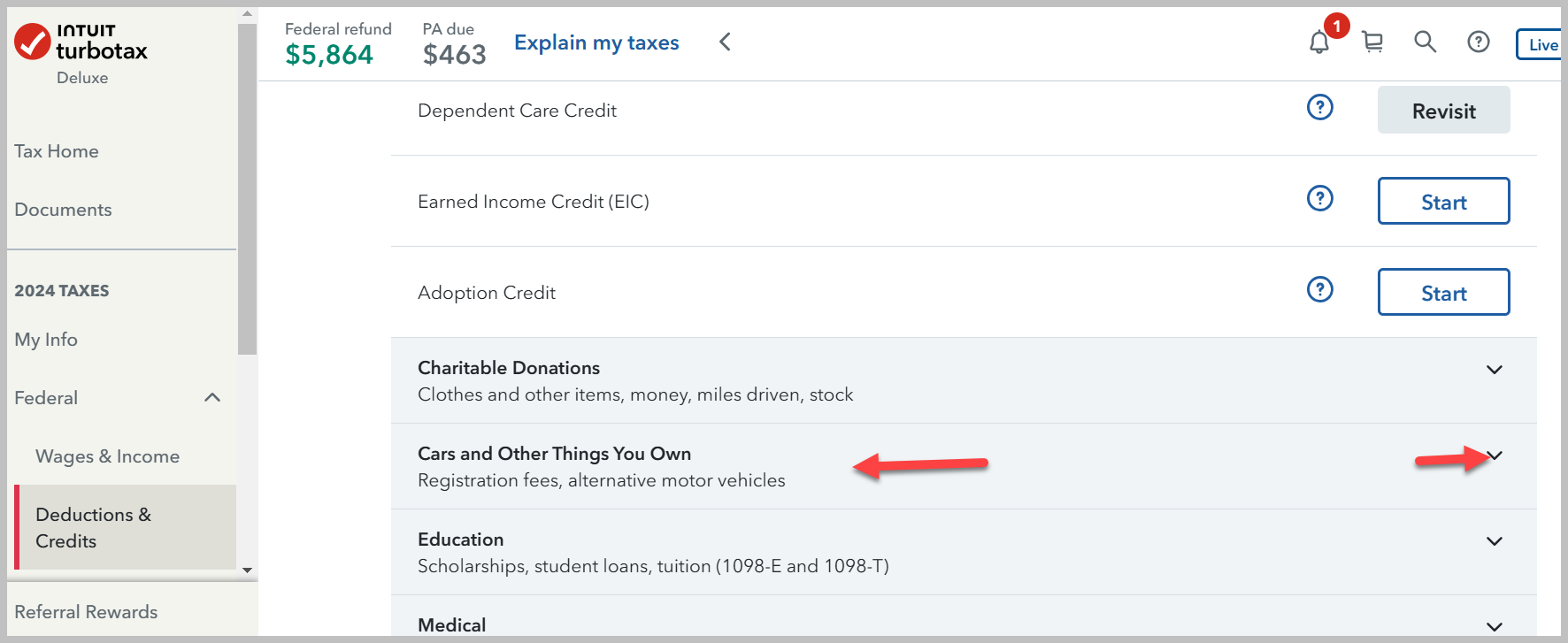

If you are using TurboTax Online:

- Continue your tax return

- In your left panel click on "Deductions & Credits"

- Scroll down to "Cars and Other Things You Own"

- Click on the down-facing caret

- Scroll down to "Energy Efficient Vehicle Charging Station"

- Click on "Start"

- Continue with the on-screen prompts until complete.

Your screen will look something like this:

It will look like this in TurboTax Desktop::

In TurboTax Online it will look like this:

This information will populate your Form 8911.

Click here for "What is Form 8911?"

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 2, 2025

5:41 PM