- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

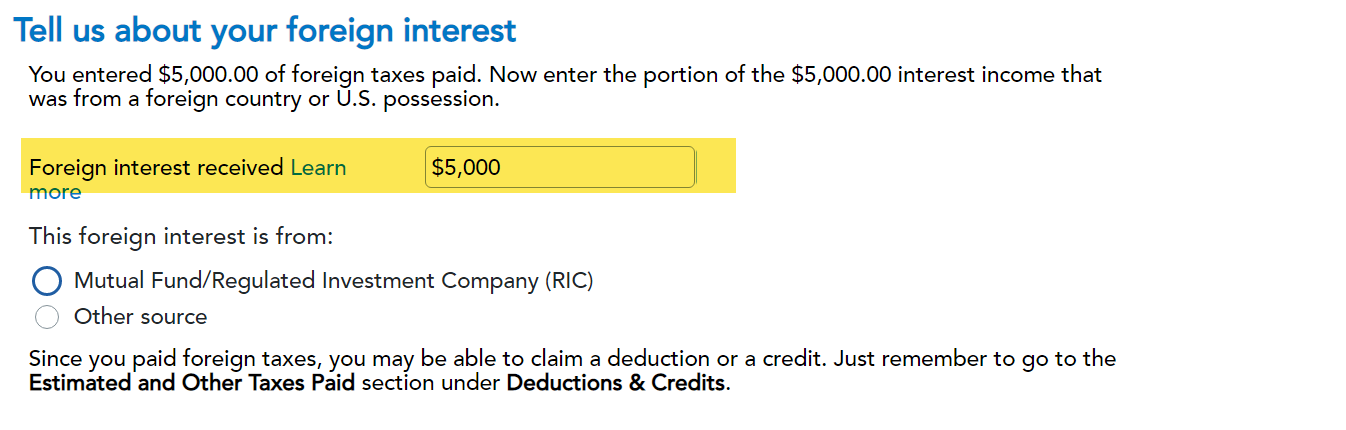

You need to first report the interest income and foreign tax paid, as you have done apparently, and in that section enter the associated foreign income on which it was paid:

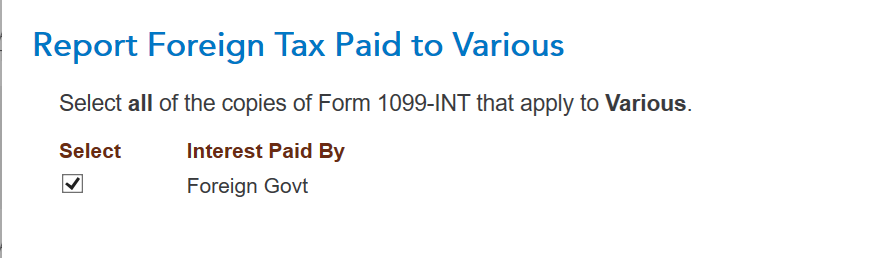

When you go through the foreign tax credit section, you need to link the interest income reported to the credit that you are working on, by checking the box that pertains to the Form 1099-INT you entered reporting the interest income:

So, you need to assign the interest income to a foreign country and assign the tax paid to the foreign interest income. You can only take a credit to the extent you report foreign income in the current year. So, first you report the interest income, then you designate it as foreign income and then assign it to a foreign country.

You may be choosing the foreign tax deduction as opposed to the foreign tax credit, which would only work if you itemize your deductions, so that could be a reason you are not getting a benefit. Also, the credit could not be more than your income tax liability, so that could be a reason nothing changes when you make the foreign tax entries.

To view your form 1040 and schedule 1 to 3:

- Choose Tax Tools from your left menu bar in TurboTax Online while working in your program

- Choose Tools

- Choose View Tax Summary

- See the Preview my 1040 option in the left menu bar and click on it

- Choose the Back option in the left menu bar when you are done

**Mark the post that answers your question by clicking on "Mark as Best Answer"