- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You can claim attorney fees as part of the Adoption Credit. You can claim expenses each year as you incur them, whether you have finalized the adoption or identified an eligible child.

The Adoption Tax Credit is only available for “qualified adoption expenses" such as:

- Adoption fees

- Attorney fees

- Court costs

- Travel expenses while away from home (including meals and lodging)

Most people who adopt a child can claim the federal Adoption Tax Credit for related expenses. This includes adoptions of foster children, international adoptions, adoptions through an agency, and even unsuccessful adoptions of a U.S. child.

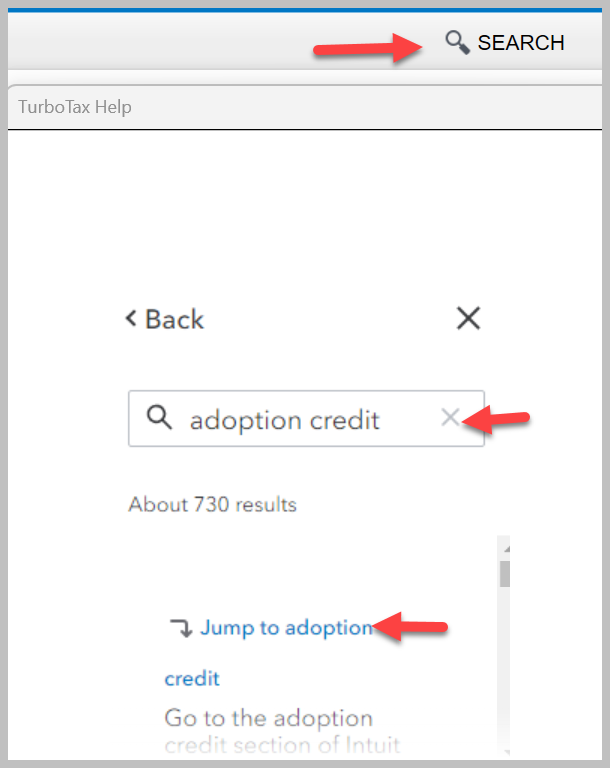

To get to those screens in TurboTax you will:

- Click on the search icon at the top right of your TurboTax screen.

- Type "adoption credit" in the search box

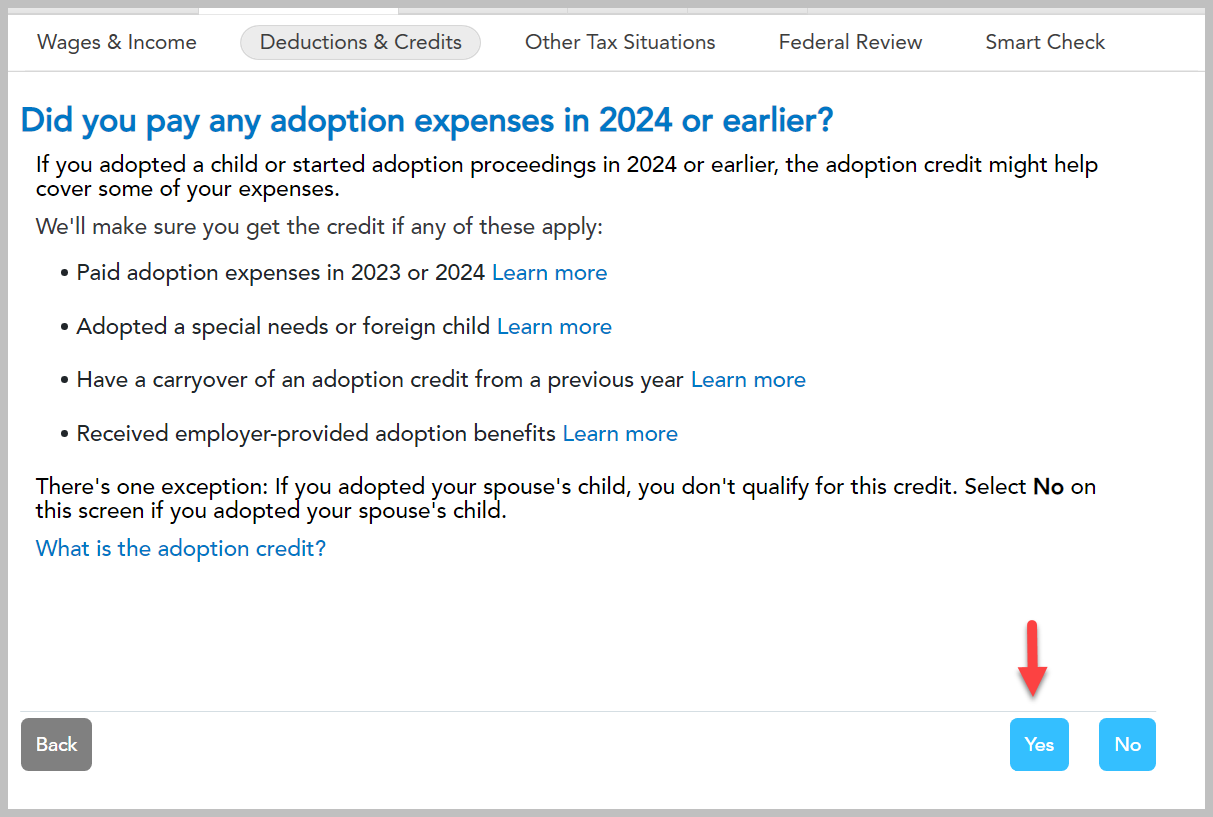

- Click on "Jump to adoption credit"

- Answer all of the follow-up questions.

Your screens will look something like this:

Click here for information on the Adoption Tax Credit.

Click here for additional information on the Adoption Tax Credit.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 18, 2025

12:45 PM