- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends- are you manually entering your HSA contributions made through payroll in the HSA entry in TurboTax? If so, you shouldn't do that as you will be double-counting your contributions. You also need to make sure you have indicated you have a high-deductible health plan all year.

Check these entries in TurboTax Online:

- Click on Federal Taxes, Deduction & Credits

- Choose "add/edit" HSA, MSA Contributions

- You will see a page titled "Your HSA Summary" which will show any deductions already computed from your W-2

- Choose Edit, Check the box for HSA, Continue

- You'll now see a screen that says "Here's what we have so far" with the information from the 1099-SA, choose "Edit"

- Continue until you get to a screen that says "Let's enter your HSA contributions"

- In the box "Any contributions you personally made (not through your employer)" DON'T enter the amounts you contributed through paycheck withholding. It has already been considered through your W-2 entry.

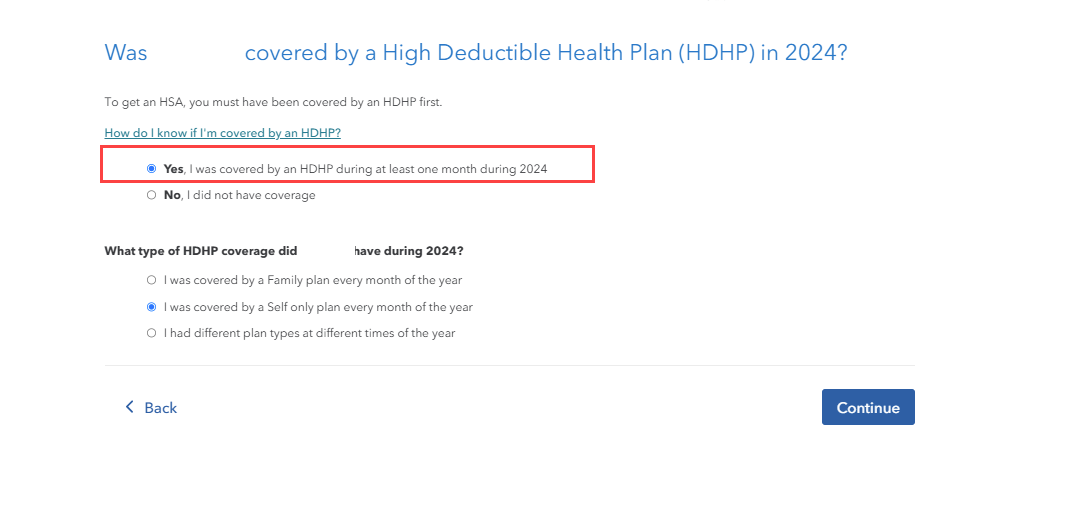

- Continue on, until you are asked if you were covered by a High Deductible Health Plan (HDHP) in 2024? You need to have been covered the whole year to be allowed to make the maximum HSA contribution, so indicate "Yes, you were covered by and HDHP during at least one month during 2024" and also that you were "covered by a family plan every month of the year."

February 15, 2025

6:30 PM