- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

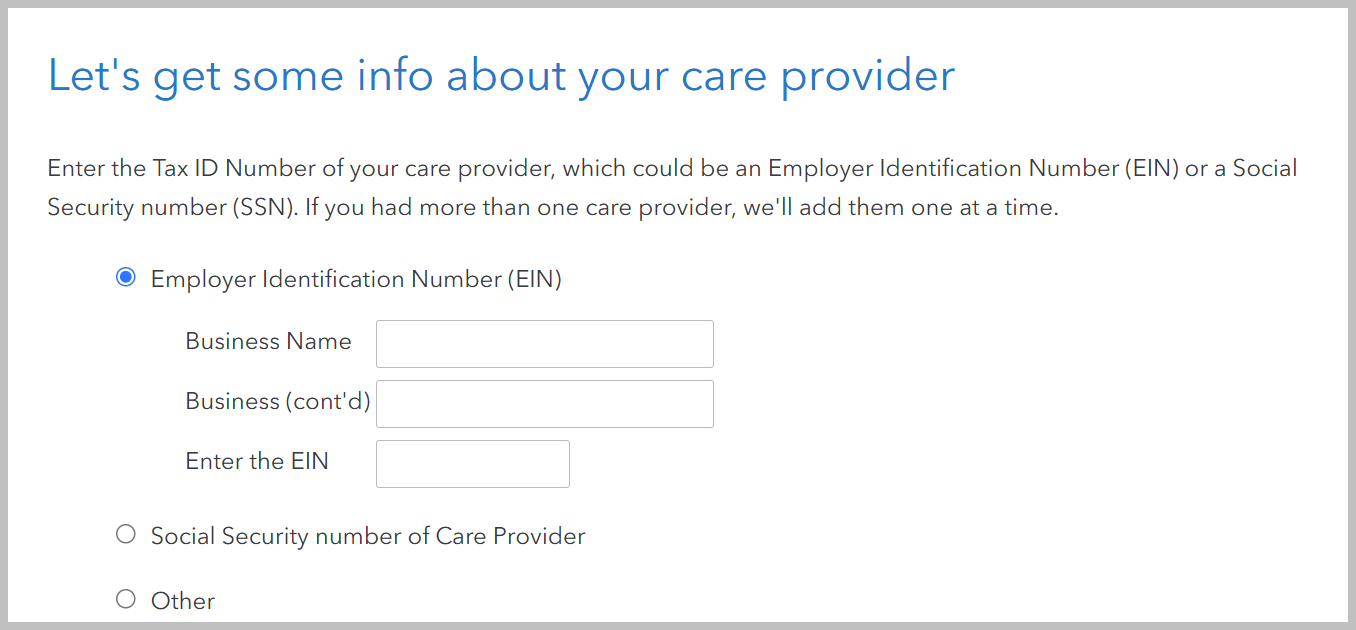

First, make sure the EIN of the provider is correct. Usually EIN numbers are 9 digits with a dash between the second and third digits. Once you have verified that the number is correct, enter it again on the return following the steps below:

- In the return, go to Deductions and credits

- Select Pick up where you left off

- Go to You and Your Family

- Then select Start/Review next to Child and Other Dependent Tax Credits.

- Answer the questions in the section

- When entering the EIN select the Employer Identification Number (EIN) and don't enter any dashes

January 25, 2025

1:12 PM