- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

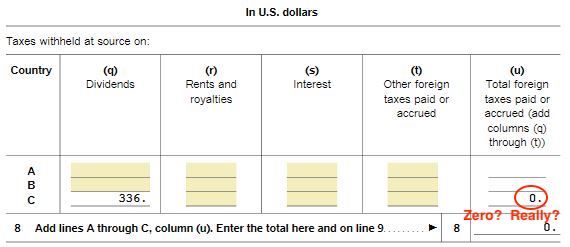

@DianeW777 I have a question about how this works in Turbotax Business for a 1041 trust tax return I'm preparing as fiduciary. I took an extension for this year to try to sort some things out, this being one of them. The trust is eligible for a $336 foreign tax credit based on dividend taxes withheld at source. But when I go to declare distributions of the trust's income to the beneficiaries, the foreign tax credit disappears and goes to $0.00.

This would make sense if the credit were divided proportionally among the beneficiaries (which is what's supposed to happen), but nothing about it appears on the beneficiary K-1s that Turbotax generates, nor on the accompanying Statement A's. So I have no idea what Turbotax is doing here. Is it reducing the total taxable income by the amount of the credit prior to figuring the taxable distributions, but without showing it? Or is it just throwing the credit away when distributions are declared?

In any case, shouldn't it generate a Form 1116 or other documentation for each beneficiary concerning their share of this credit?