- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My mother can claim me as a dependent, but TurboTax is forcing me to say I'm not claimable at all due to her not having to file taxes.

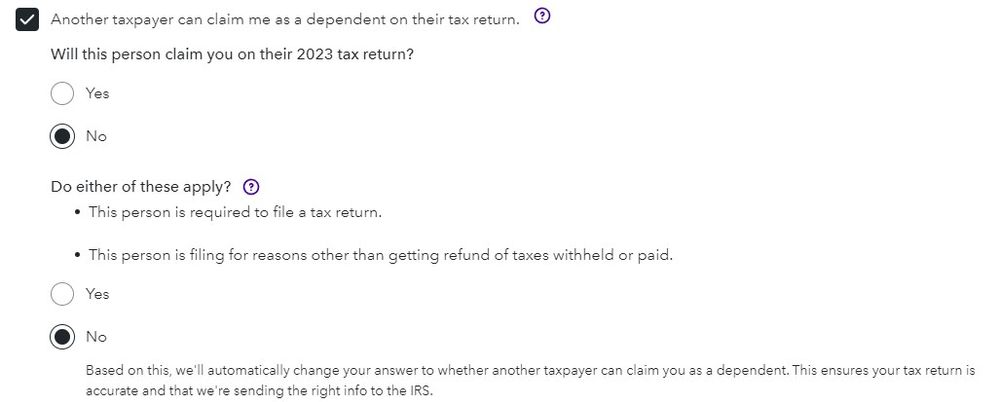

I have checked the "Another taxpayer can claim me as a dependent on their tax return" box because I meet all the criteria for being a dependent of my mother. No one else can claim me for the 2023 year, only her (it used to be my father in past years but now he fails the Gross Income Test for Qualifying Relatives). However, she has not been required to file tax returns due to having no income (she gets support through the divorce settlement). When I mark the subsequent boxes about how she will not claim me because of this, and mark the next box confirming this is because she is not required to file a tax return, TurboTax says they will change my dependency status back to "No" despite being a dependent of my mother. I included the screenshot below.

TurboTax says in response to my above responses that "Based on this, we'll automatically change your answer to whether another taxpayer can claim you as a dependent. This ensures your tax return is accurate and that we're sending the right info to the IRS."

I have verified that I am a dependent of my mother through the IRS dependency quiz on their website. Isn't it tax fraud to say you're not a dependent when you are? TurboTax seems to be forcing my answer here.

I'm confused here and worried about tax fraud issues. Aren't you still considered a dependent regardless of if the person who can claim you will file a tax return? My mother can claim me as a dependent on her tax returns, but she is not required to file one and won't be doing so. TurboTax seems to be forcing me to say I'm not a dependent when I am.