- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

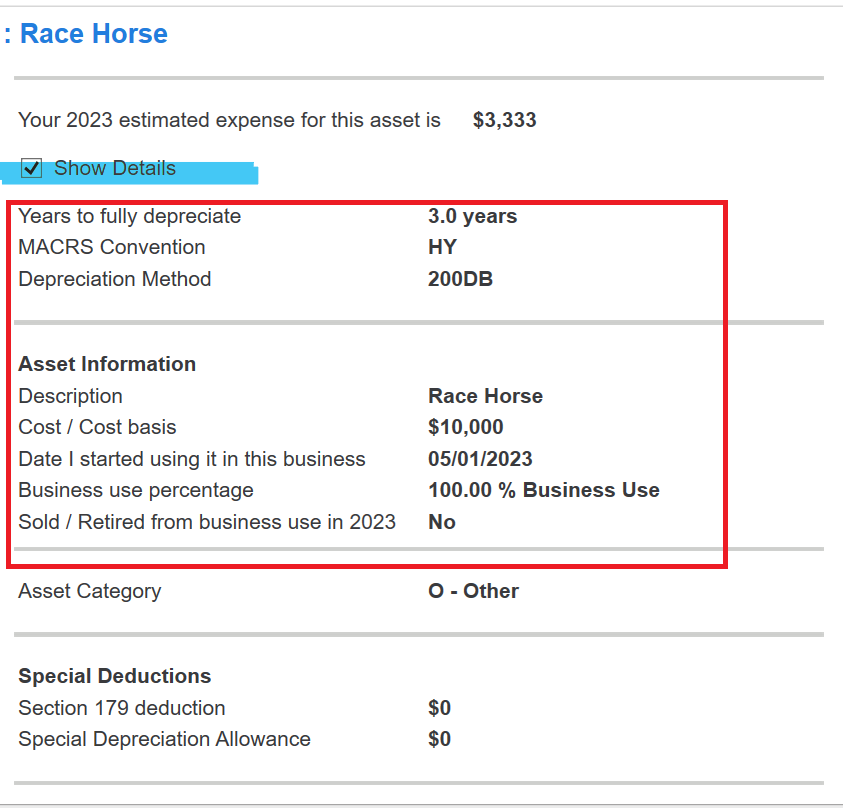

You are correct. The steps below will show you how to arrive at the correct recovery period of 3 years GDC MACRS.

3-year property.

- Tractor units for over-the-road use.

- Any race horse over 2 years old when placed in service.

- Any other horse (other than a race horse) over 12 years old when placed in service.

- Qualified rent-to-own property (defined later).

Steps to entry of your race horse:

- Sign into your TurboTax return > Search (upper right) > Type schedule c > Click the Jump to... link> Edit or Update beside your business

- Scroll to Assets > Add or Update your Asset > On the page 'Describe this Asset' select Intangibles, Other property > Continue

- Select Other asset type > Enter the details of your asset/race horse > Continue > Check the box 'I purchased this asset and Yes I've always used this item 100% of the time for business'

- Enter the date you first started using it for business > Continue > Select Asset class 3 year > Continue > Select 200% Declining Balance > Continue >

- Select No 'Does this asset qualify as listed property' > Select 'I'll spread the deduction over several years (or other selection) > Continue

- Arrive at the Asset Summary > Click Show Details to see your depreciation calculations

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 6, 2024

4:18 PM