- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

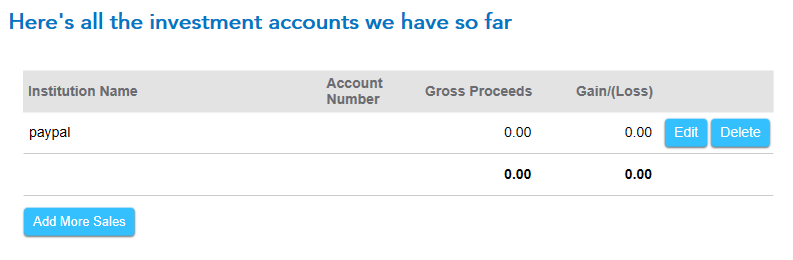

You should be able to view the 1099-B entries on Schedule D in Forms. The proceeds received for the personal items on Schedule D will equal the total of the IRS form 1099-K's that have been entered.

You entered the IRS form 1099-K's and selected Personal item sale.

If so, the entry of the 1099-K has created a worksheet in which you need to enter the personal items, their costs, selling prices, dates and other information.

Each worksheet will generate entries that flow to the Schedule 8949 / Schedule D Capital Gains and Losses.

The total of the proceeds column should equal the total of the IRS form 1099-K or the software will give you an out of balance error message.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 19, 2023

5:28 AM