- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

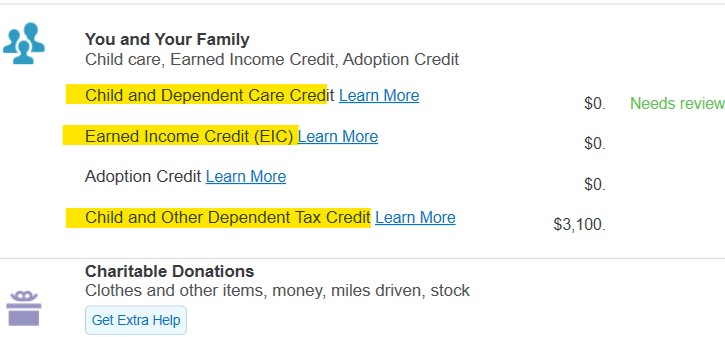

Deductions & credits

You have to enter the dependent information in the dependents section and then you have to walk through each of the credits in the Deductions and Credits section. Be sure to visit the Child Tax Credit, Earned Income Credit, and Dependent Care Credit sections - all in the Deductions and Credits section. You must have earned income entered to get these credits, so make sure you have already entered all of your income before visiting the Deductions and Credits section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 4, 2023

8:03 PM