- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ordinary versus Qualified dividends - Why does my Vanguard 1099 include the qualified total under ordinary in box 1a and it is added to income

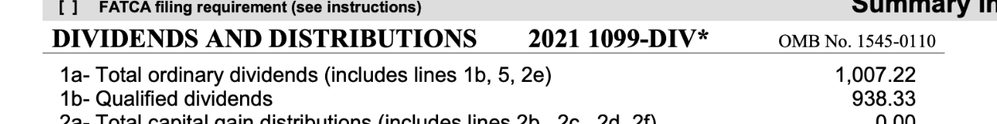

I was reviewing my sons 2021 tax return and noticed something odd. He makes under 40k and had $938 in qualified dividends (box 1b) on his VG 1099 which should be counted as cap gains and his tax rate should be 0% I think. But I see VG reporting $1007 in ordinary dividends (box 1a) which on the 1099 form shows it includes the qualified amount (box 1b) (so my assumption is only 1007-938 or $69 should be ordinary and added to his income.

So that $1007 (it's in box 3B on the 1040) appears to be added to his income instead of the $69. Is this right? It doesn't seem right.

Shouldn't VG exclude qualified from Ordinary on their 1099 which loads automatically into TT?

August 20, 2022

4:07 AM