- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Since you don't say exactly what error you are receiving, return to the Business Asset section where you set up your vehicle.

Technically, you may have a Gain to report on the sale of a Business Vehicle if you sold it for more than the current Cost Basis. That would be the FMV when you first started using it for Business, less depreciation claimed over the years.

When you claim the standard mileage rate when deducting your business miles, you have to account for the 'depreciation equivalent' when you dispose of the car. So you will need to do some math here.

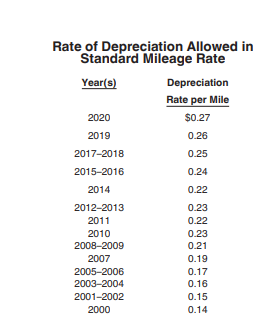

Multiply the number of Business Miles you claimed each year by the amount shown for that year in the following table (page 24 in IRS Pub. 463) to determine your 'Prior Depreciation' amount to enter in TurboTax.

So, for example, you paid 15K for a vehicle that was worth 10K FMV when you started using it for business. Over the years, using the table, you claimed 8K in depreciation. The Cost Basis for that vehicle is now 2K. If you sold it for 3K, you have a Gain of 1K to report.

Yes, you can choose 'converted to personal use' in the Vehicle Asset section and not report sale details in the Vehicle Asset section. However, it is expected that you will report the sales details under 'Sale of Business Property' and report the Sale Amount, Prior Depreciation Claimed, and Cost Basis of the vehicle (FMV when you first started using for business), and probably end up with the same amount of Gain to report.

**Mark the post that answers your question by clicking on "Mark as Best Answer"