- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I think I have narrowed it down to what the official answer would be for our situation and it correlates to the suggestion of @LeonardS

When I search for "report taxable income from sale of used items", I found a website for Tax law.

https://www.lsnjlaw.org/Taxes/Other-Federal-Tax/Pages/Ga[product key removed].aspx....

The link clarifies that you either have a business or you have a hobby. That it's important to distinguish which of the two best defines your situation.

If your online sales remain a hobby, your expenses cannot exceed the income from the activity. This means that you cannot report a loss. You can, however, deduct your expenses up to the amount of your hobby income. IRS Publication 535 discusses the factors to consider in determining whether your online sales are a business or a hobby. The hobby vs. business debate matters when it comes to self-employment tax obligations and the ability to deduct operating costs.

When I review IRS Publication 535, I see that they provide a guide in making this determination.

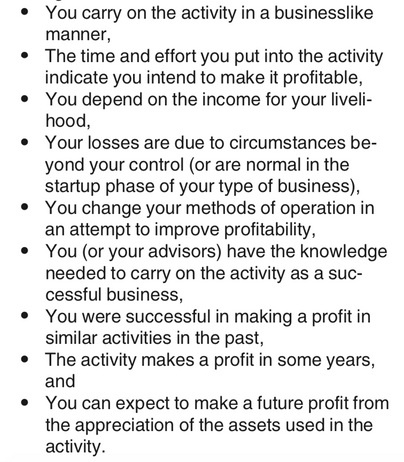

In determining whether you are carrying on an activity for profit, several factors are taken into account. No one factor alone is decisive. Among the factors to consider are..

Additionally, it goes on to clarify the presumption of profit

Presumption of profit. An activity is presumed carried on for profit if it produced a profit in at least 3 of the last 5 tax years, including the current year.

I can now rest my concerns in knowing that a Schedule C and filling it as business income is not the correct response and that this would in fact be considered a Hobby at this time.