- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

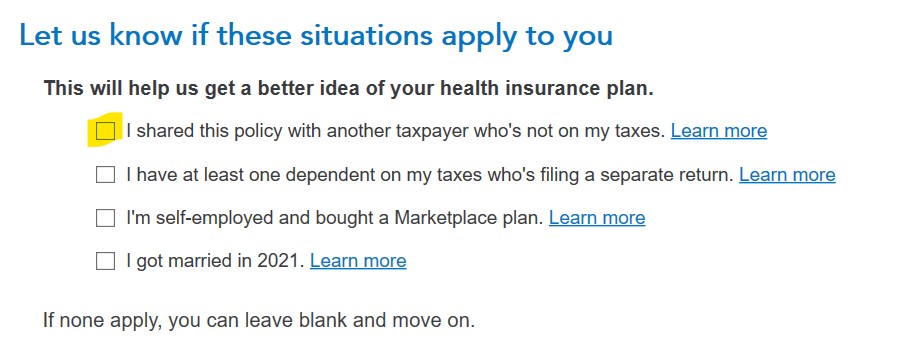

You both need to enter the Form 1095-A on your respective tax returns. Your tax return keeps getting rejected because your dependent (your brother) has a 1095-A out there. After you enter the form, there is a button that says ''I shared this policy''. Clicking on that button will allow you to divide the policy with your dad in any manner that you two agree on. You can choose to allocate 100% of the policy and advance premium tax credits on your return or your dad's return, or you can split it 50/50, 80/20 or any other percentage set that adds up to 100.

When you enter the Form, enter it exactly how you see. TurboTax will do the division when you indicate how you want to allocate the policy. Just make sure that when you dad does his tax return, he allocates the amount (0-100%) you have agreed upon and that the total of the columns between your two tax returns equals 100%. This is necessary to prevent any delays in filing.

You will have to see which option is best for you and your dad. Since the policy was in his name, he may have already received advance premium tax credits for your brother that he doesn't qualify for because your brother is your dependent. Being able to allocate the premiums and advance tax credits may allow him to avoid having to pay anything back (assuming he took the advance credit).

**Mark the post that answers your question by clicking on "Mark as Best Answer"