- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If your husband had properly put his information into the return Turbo Tax DOES properly apply payment forgiveness. To test.

- I adjusted my income below $40,000.

- I then reported I received $3600 in ACTC.

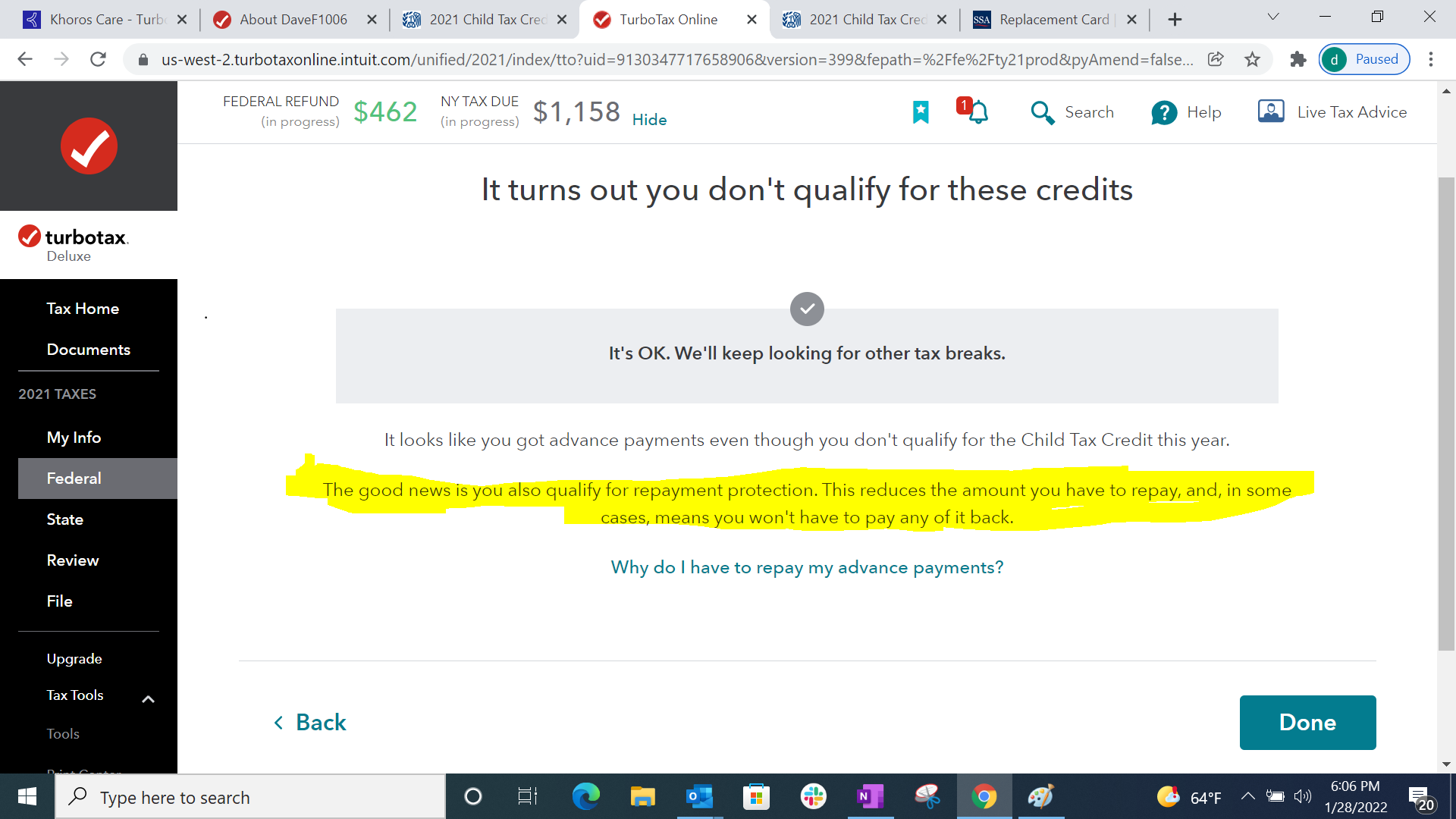

- After entering, I received a message telling me I do not qualify for the Child Tax Credit but "The good news is you also qualify for repayment protection. This reduces the amount you have to repay, and, in some cases, means you won't have to pay any of it back." i will show you the screen at the end of this post.

To qualify for a forgiveness repayment, the following parameters must be met.

- $60,000 if you are married and filing a joint return or if filing as a qualifying widow or widower;

- $50,000 if you are filing as head of household; and

- $40,000 if you are a single filer or you are married and filing a separate return.

Here is the screen image I am talking about:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 28, 2022

6:20 PM