- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@OhHowIHateTaxes wrote:

Yep Got the same letter too! Our AGI is clearly in excess of the $150k limit so I'm not seeing why the program says we qualify. I went into Turbotax and "Continued My return" and it again told me Great News! You qualify for the Recovery Rebate Credit. Kinda pissed I have to send the IRS a check for an additional $1,300 PLUS a $12.40 interest charge!!!!

Hey Intuit can I get my $12.00 back?????

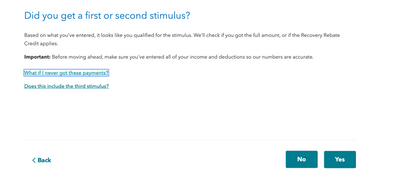

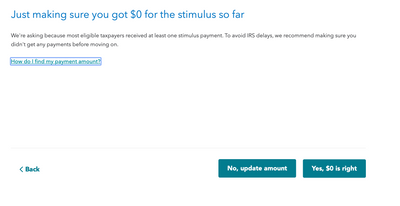

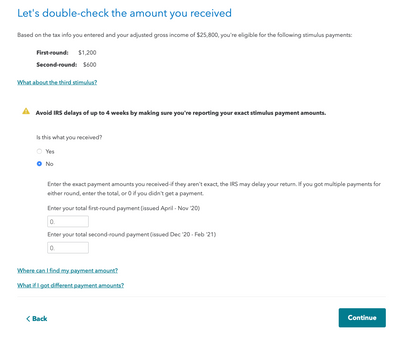

This is what the section looks like on Turbotax. If you said "NO" to the first question (did you get a payment), then Turbotax would claim a rebate based on your income.

The credit is reduced 5% for every $1000 of income over $150,000 (for married filing jointly). This means, for example, that if your income was $190,000, you would be entitled to $400 for round 1 ($2400 base amount minus 5% of $40,000) and zero for round 2.

It sounds like you told Turbotax you did not receive a stimulus, and the IRS disagrees. If you think you did tell Turbotax the correct amount of your stimulus payments but the program recorded zero anyway, you can try filing a claim for the accuracy guarantee.