- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax cred

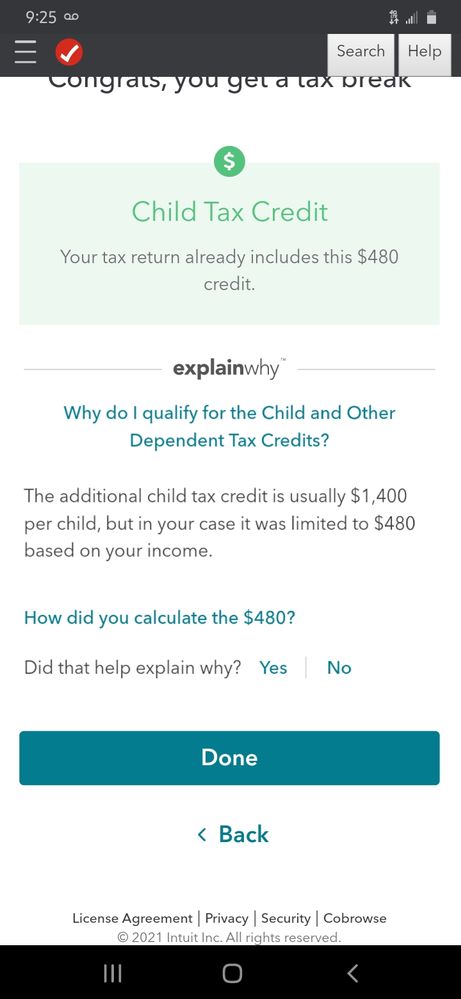

Isn't the child tax credit fully refundable this year? It said I only qualified for $480 but usually you get 1400 per child. I have two children but only made under 6k last year. Will I get that money? Do i need to amend or will it happen automatically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The additional child tax credit is based on how much income you earned from working. You get 15% of the amount earned over $2500. It is not a flat $1400 per child. You say you earned less than $6000---so subtract $2500 from the amount earned and multiply by 15%.

And the increased child tax credit is for 2021--not for 2020.

That CTC increase is not for 2020; it is for 2021. Your 2020 return does not have to be amended for it. More information will be available soon; the details of how it will be implemented have not yet been clarified fully. There may be monthly payments going out beginning in July 2021, with some of the CTC still left as a refundable credit on your 2021 tax return next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

For 2020, the child tax credit is a maximum of $2000. If you don't owe any tax because of low income, you can get up to $1400 per child, but this depends on how much income you have from working--it's not free money, the more you work, the more credit you get. What Turbotax told you is what you get.

For 2021, the credit will be $3000 (or $3600 for children under 6) and you don't have to work to get it. This is a temporary change so far, and the credit will go back to the old rules for 2022, unless Congress passes another update to the law.