- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You would only enter the first stimulus payment you received in January 2021, which was actually stimulus payment #2. Most likely, the second stimulus you received was actually stimulus payment #3, which is not entered on your 2020 tax return.

If you are qualified based on your 2020 Adjusted Gross Income (AGI), then you would qualify for the Recovery Rebate Credit for the first stimulus payment. This payment was sent by the IRS around mid-April of 2020.

To enter, please follow the steps below:

- With your return open, search for stimulus with the magnifying glass tool on the top of the page.

- Select the Jump to Stimulus in the search results to directly go to correct TurboTax page.

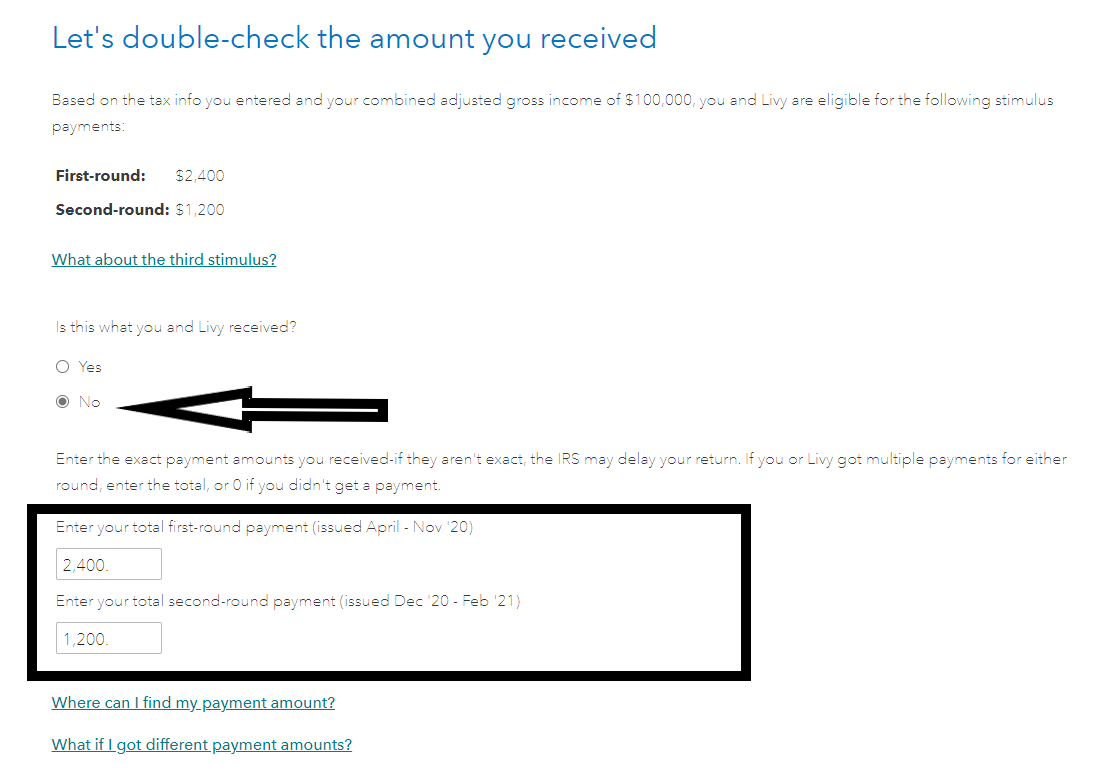

- You will come to a page titled Let's double-check the amount you received and it will list the first-round and second-round payments based on your 2020 return.

- Answer No for the question, Is this what you received?

- Enter the amounts of the first ($0) and second round stimulus payments you received. I have attached a screenshot below for additional guidance.

Your Recovery Rebate Credit will be the difference between what you were qualified for on your 2020 tax return less the amount of your first and second stimulus payments you have already received. This will be a credit on your tax return, shown on Line 30.

**Mark the post that answers your question by clicking on "Mark as Best Answer"