- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

If you had no balance left because you paid it off, you would need to enter zero for the ending balance.

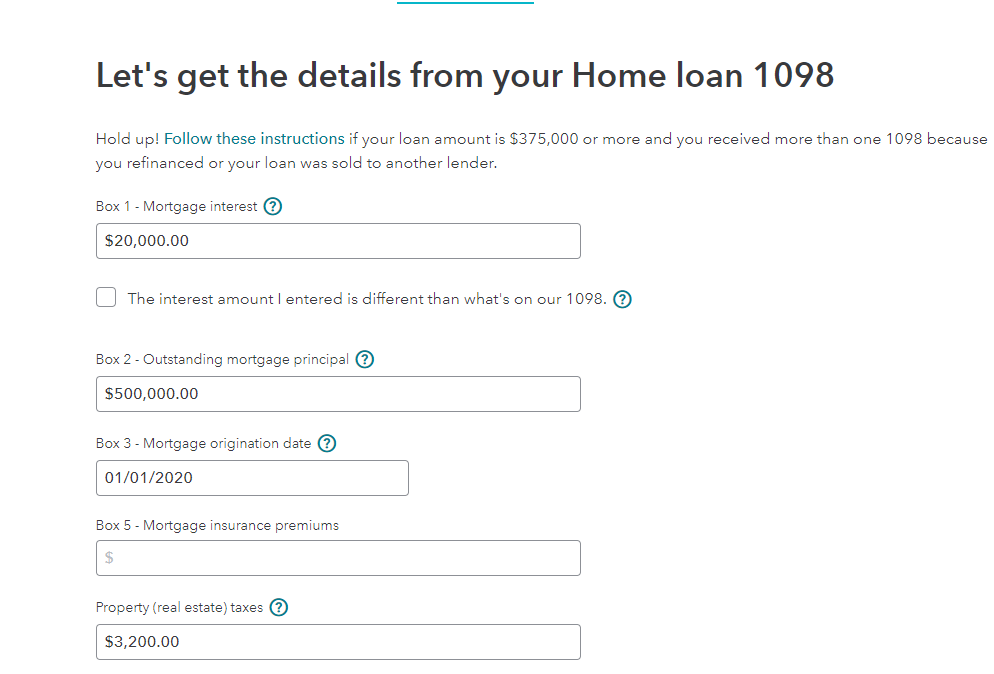

You can enter your 1098 Forms into the program in the federal section of the program.

- Select Deductions & Credits

- Select Mortgage Interest and Refinancing (Form 1098)

- At the bottom of the next page, select Add another 1098

- Be sure to answer the questions carefully for each 1098

Be sure that you have entered $0 for the loan that was paid off in Box 2 - Outstanding mortgage principal on the screen titled Let's get the details from your Home loan 1098.

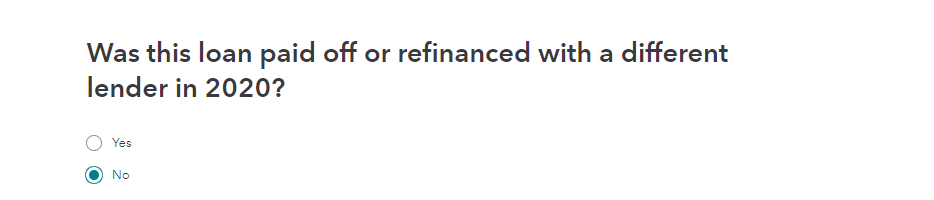

You will also want to select that the loan is no longer there at the end of the year is marked as paid off during the year.

Please see the link below for more information on the mortgage interest deduction.

Deducting Home Mortgage Interest

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 28, 2021

5:13 PM