- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

To enter an asset using straight-line depreciation, use these steps:

- Navigate to the area of your tax return where you want to enter a depreciable asset

- Click Add an Asset

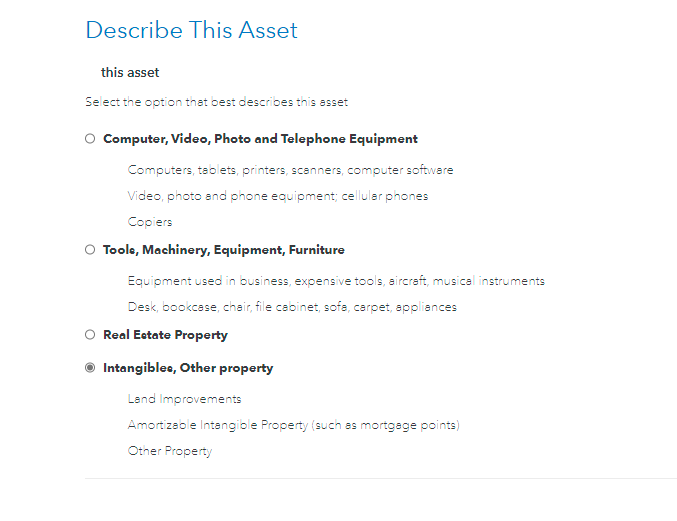

- On the screen titled Describe This Asset, choose Intangibles, Other property then click Continue

- On the screen titled Tell Us a Little More, choose Other asset type then click Continue

- On the next screen, enter the details for the description, cost, and date purchased or acquired then click Continue

- On the next screen, continue adding details regarding the asset and click Continue

- Next, choose the appropriate asset class (class life) and click Continue

- Depending on the date the asset was placed in service, there may be an additional screen asking for more information

- Next, choose the Straight Line depreciation method, then click Continue

- There will be additional questions to review your entries and add more details if needed (such as depreciation taken in prior years)

- Continue going through all screens until you get back to your summary screen showing your complete list of assets

March 6, 2021

11:05 AM