- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

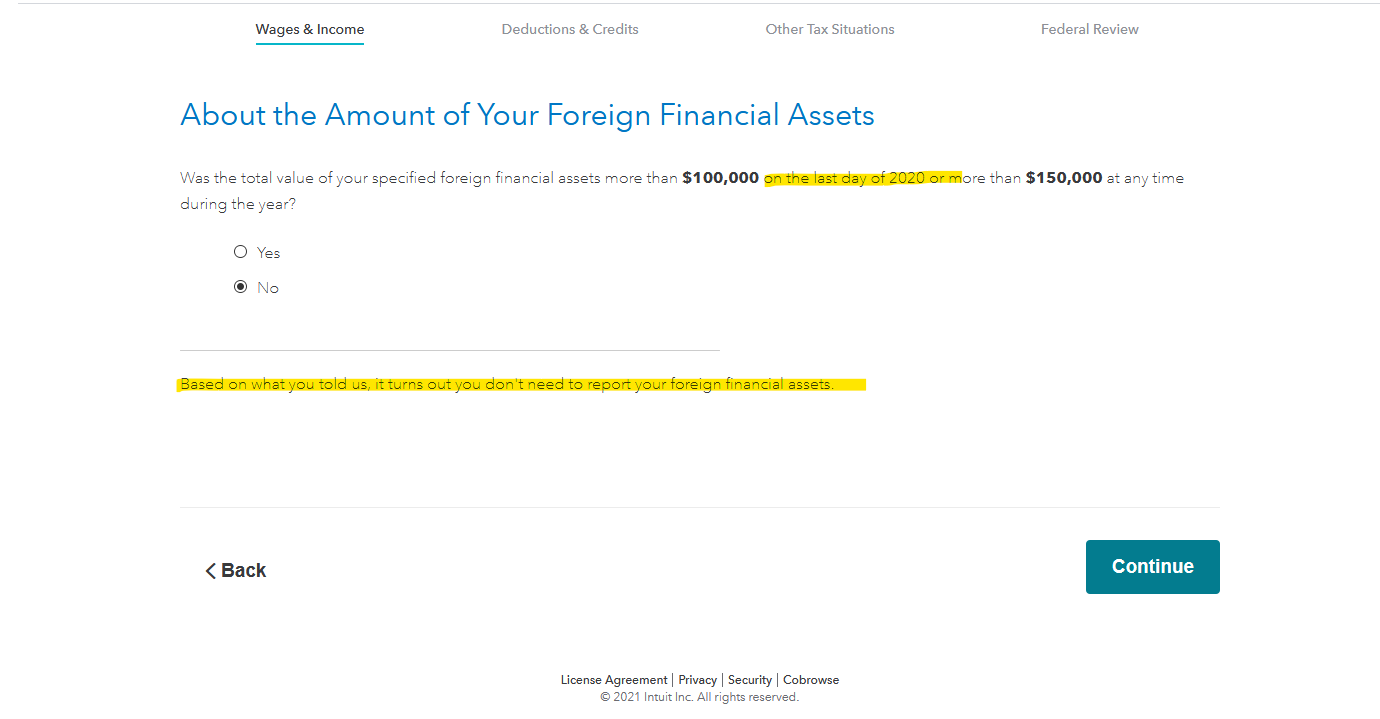

When you go through the 8938 section in the program, the first question asks you "if you have total value of foreign assets on the last day of 2020", if you have closed the account, you would answer No to that question. By doing so will not generate a Form 8938. See image below.

If you live in the US and meet one of the following criteria, you would need to file a Form 8938.

- Unmarried individual (or married filing separately): Total value of assets was more than $50,000 on the last day of the tax year, or more than $75,000 at any time during the year.

- Married individual filing jointly: Total value of assets was more than $100,000 on the last day of the tax year, or more than $150,000 at any time during the year.

For more information, click here: https://www.irs.gov/businesses/comparison-of-form-8938-and-fbar-requirements

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 1, 2021

2:11 PM

246 Views