- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You would do this in the federal interview section.

- Select Deductions & Credits

- Scroll down to All Tax Breaks

- Select You and Your Family

- Click Show more and select start (or revisit) under Adoption Credit

- Select your child's name, and click edit.

- After going through all of the screens, you will see a page which says Review your adoptive child info.

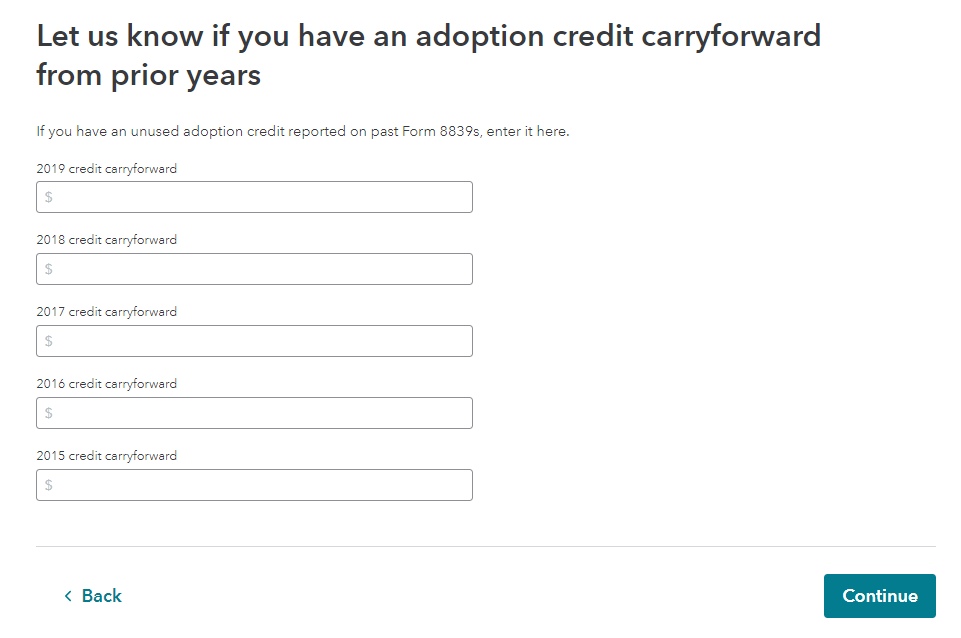

- Click done at the bottom of that page. This will get you to the carryforward screen.

- On this screen, please confirm the amounts you have from your prior year tax returns to ensure the carryforward amount for the 2020 tax year is zero. This will ensure all returns filed from this year forward are correct and remove any future credit carryforward amounts from being populated.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 30, 2021

2:21 PM