- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter interest paid on a home improvement loan in Turbo Tax when lender will not provide a 1098 (Schedule A line 8b)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Use the type it in yourself option and then the seller financed choice :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

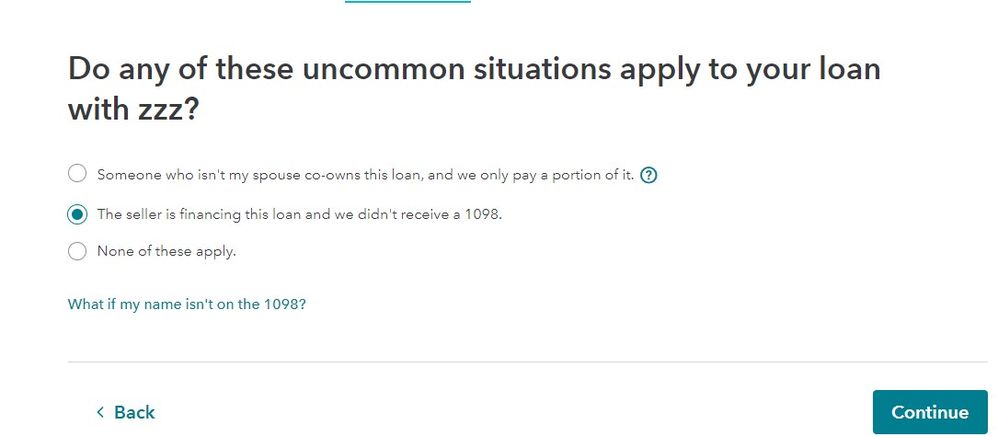

The first screen will ask you for the lender's name. On the second screen (Tell us more about your loan), choose the option that says ''This is a seller-financed loan and I did not receive a 1098''.

For tax years 2018 through 2025, you can only deduct the interest from the amount of your loan that was used to buy, build, or improve the home that it’s secured by.

If you’ve ever used part of this loan to pay for things other than this home, you cannot deduct the interest from that amount of the loan, even if the transaction didn’t take place this year.

You may be able to get your mortgage info by going to your lender’s website. Other documents, like your monthly mortgage bills and your Closing Disclosure (or HUD-1), will also have some of this info. Your lender should send you a 1098 by January 31. If you haven’t received one by then, contact them for the info you need.

**Mark the post that answers your question by clicking on "Mark as Best Answer"