- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claim missing stimulus check on 2020 tax return?

My wife and I immigrated to the US a number of years ago. She received a Social Security number with a 'Not valid for work' designation. A few years later, we got a green card and she was allowed to work.

As we didn't automatically get a stimulus check, I called the IRS and they told me: "Because of the flag on your wife's SS number, you're not eligible", even though our 2018 and 2019 tax returns were happily accepted with her working on in. I called the SS, but in order to change it, I have to mail her passport and green card, which I'm really uncomfortable doing (these are the two most important documents in her life)

I read it might be possible to claim the stimulus amount as a credit on our 2020 tax return.

Does any body have more information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes the stimulus payment is actually an advance for a credit claimed on a 2020 tax return filed in early 2021. You can claim the credit when you file your 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

But in order to qualify for the credit on the 2020 tax return, she still needs to update her Social Security Card/Number that is valid for employment.

Have you asked if they are able to update her card with a face-to-face appointment, so you don't need to mail her documents? If you do need to mail her documents, you may consider Registered Mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No face to face appointments in San Jose at the moment, but hopefully they will open again before 4/15/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@JVM1 wrote:

Were on the 2020 will I enter for this credit

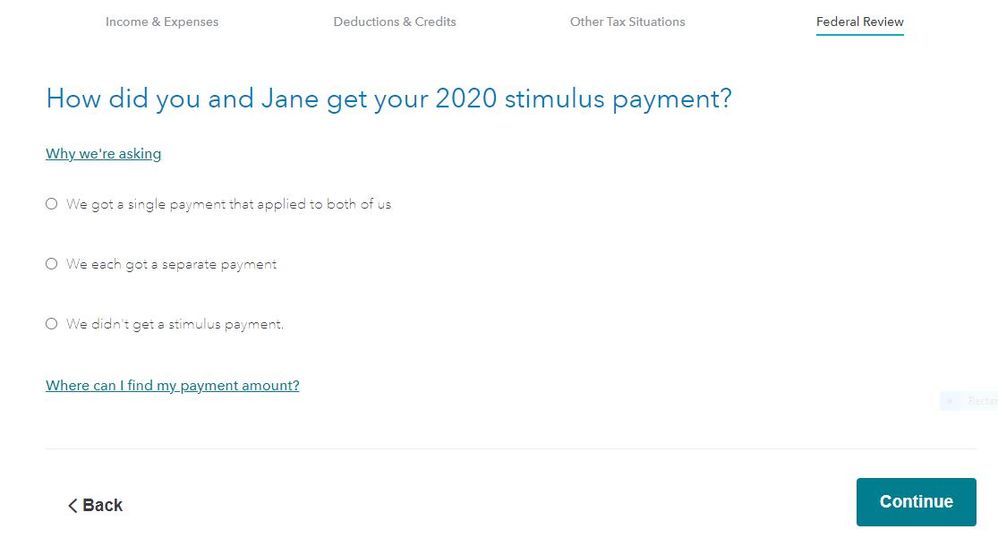

The TurboTax program will ask you about any stimulus payment after you complete the Other Tax Situations section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

you will see the credit on line 30 for Form 1040, but with out clearing that flag, it will remain a problem

The form that occurs 'behind the scenes' requires a 'valid social security number; and that is defined in the Form 1040 instructions as

Valid social security number. A valid social security number is one that is valid for employment in the United States and is issued before the due date of your 2020 return (including extensions).

So seems like you have to clear up the issue prior to April 15 or request an extension to Oct so that you are eligible for the stimulus.

https://www.irs.gov/pub/irs-dft/i1040gi--dft.pdf

see page 56 of the instructions (look at the right most column for the definition I posted above)