- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You may not have had enough in itemized deductions this year where your charitable contributions made a difference. Another words, a standard deduction benefited you more then your itemized deductions. Here is more information on the standard deduction compared to the Itemized Deductions. Itemized Deductions Vs. Standard Deduction.

Clothing donations made to a charitable organization can be claimed on your federal itemized deductions. You can add these in TurboTax by following these steps:

- While in your Tax Home,

- Select Search from the top right side of your screen,

-

Enter Charitable Contributions,

-

Select Jump to Charitable Contributions,

-

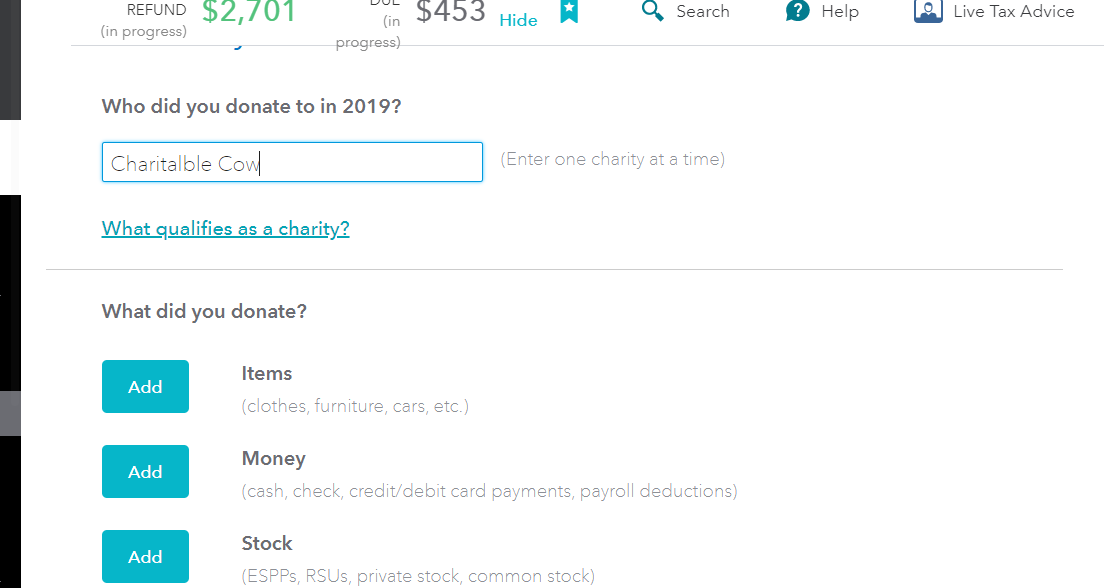

When you add a charitable contribution, you will get to this screen which allows you to select the type of donation you are making.

-

Follow the On-Screen Prompts to complete this section.

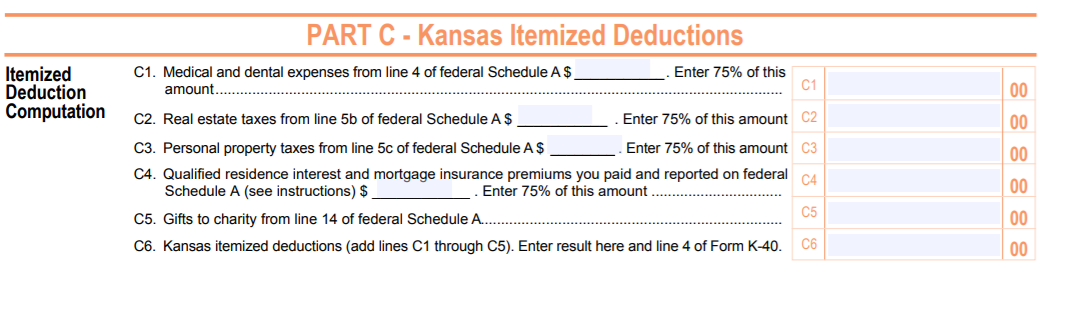

The State of Kansas Itemized Deductions allow what you have claimed on your Federal Return for Charitable Contributions. Here is the State of Kansas Tax Form Supplemental Schedule S.

**Mark the post that answers your question by clicking on "Mark as Best Answer"