- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends.

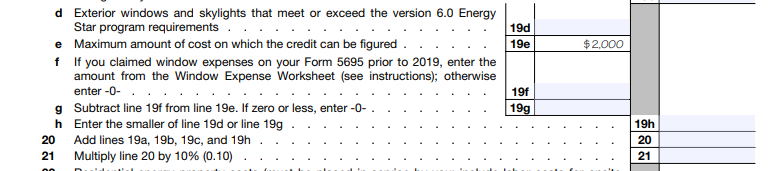

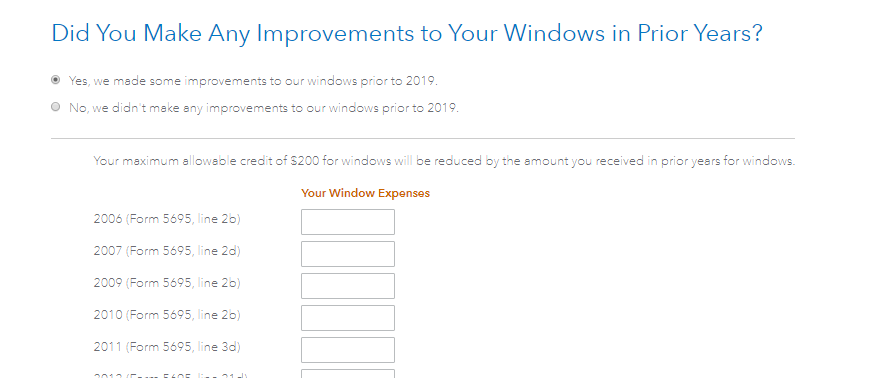

There is a lifetime limitation on your window expenses. The amount you may be able to deduct is determined by entering the credit entered in the prior year against the amount you are currently claiming. It is not an improvement per house credit, but a taxpayer credit.

I recommend you go ahead input your information as directed below. TurboTax will do the calculation based upon the amount of the credit from the prior years against the amount spent this year.

- Go to the Federal section

- Select "Deductions & Credits"

- Scroll through all tax breaks until you see the section titled "Your Home."

- To the right of "Home Energy Credits", select revisit/start

Answer the questions as prompted. You will get to a screen which starts asking for information regarding carryforwards from prior years. Enter the information as it applies to your situation.

Pay attention to the questions as they start with 2019 information and then go into improvements from prior years. The information requested for the prior years will show you the year, Form 5695, and the applicable line number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"