- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends on what activity you are using your vehicle for.

If it is for a rental, you will go into the federal program.

- Select "Income & expenses"

- Select "Rental Properties and Royalties (Sch E)

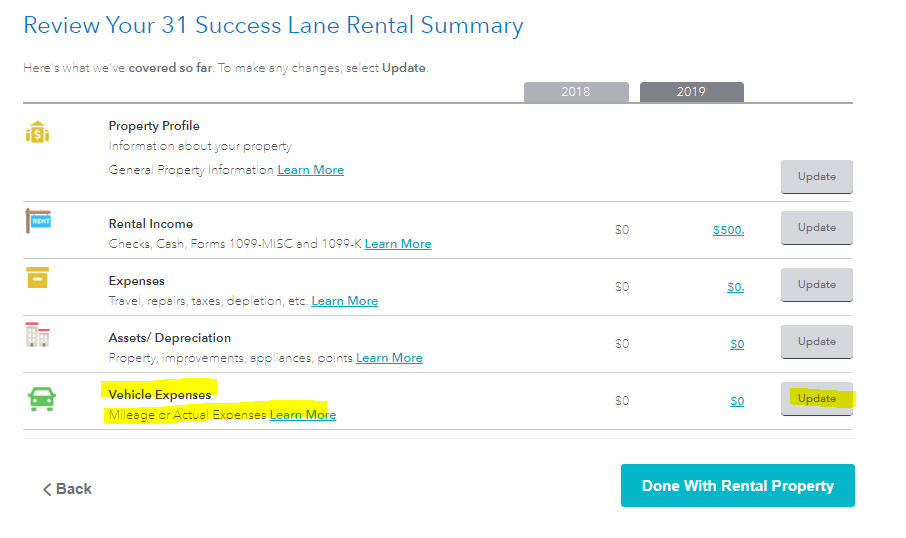

- Say yes to reviewing your information and continue through the screens until you see the "Rental and Royalty Summary".

- Select Edit to the right of the applicable activity

- You will then see a section titled Vehicle Expenses. Select update to input your information.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 15, 2020

6:42 PM