- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi,

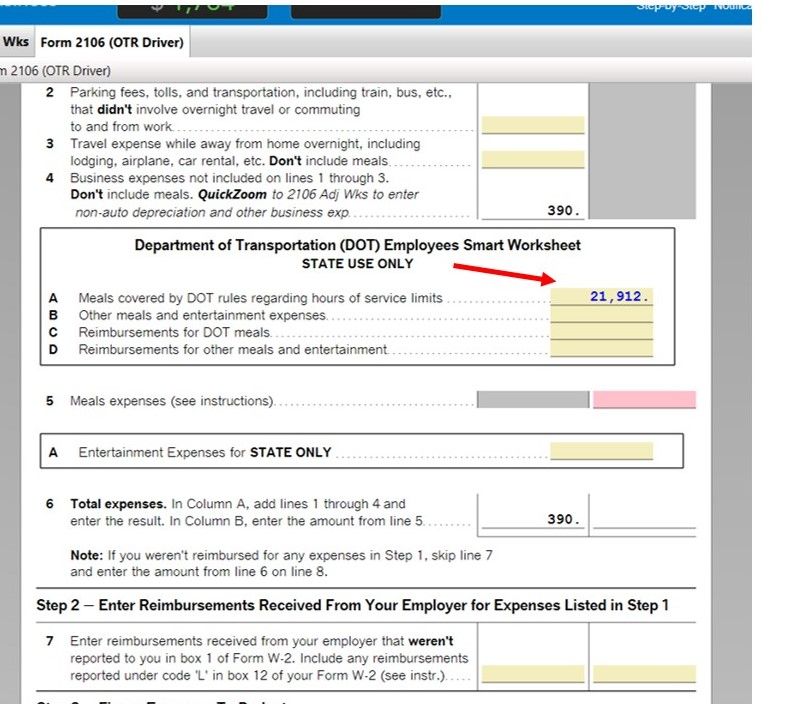

Thanks for asking the questions of the guy above. My son is dealing with a similar situation, as an OTR (CDL) Truck driver, and trying to deduct the DOT Meal expenses. TurboTax is only allowing for State only (see attached 2106 worksheet). Is this deduction only for state, due to limitations? AGI was around $36K, and meals were in excess of $20K since he was on the road most of the year, away from home, sleeping in his truck. Is TurboTax wrong in the software? Or is this a deduction that was eliminated?

February 15, 2020

3:39 PM