- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

It is probably an error in how you prepared the state returns. California taxes you on all income earned while a resident or from California sources while a nonresident.

I recommend following the steps below to ensure your returns are calculated correctly.

In the My Info section of TurboTax, confirm that you have entered the correct state information:

- Click Edit to the right of your name

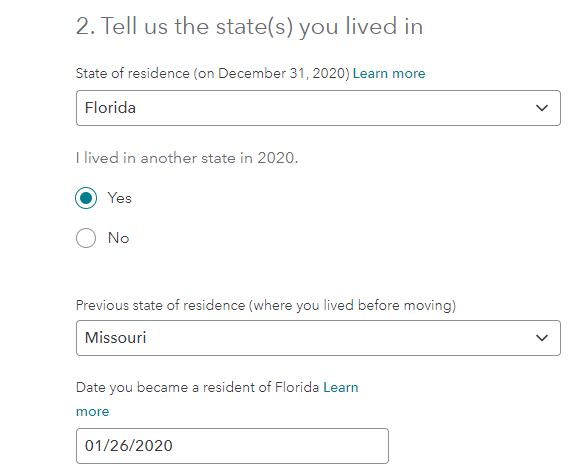

- Confirm your input under #2 Tell us the state(s) you lived in. Be sure to answer the questions accordingly so New Jersey is reflected as your residence on December 31st. (see the sample screenshot below)

- Go back to the personal information section, and verify the mailing address and "Other state income" section. Be sure to answer yes to the question asking "Did you make money in any other states?" to reflect your wages in New York.

Please note the following as it will affect the calculations:

When you are preparing more than one state return, make sure you prepare the part-year resident California state tax returns first. Be sure to answer the questions correctly to ensure only income sourced to that state specifically are reported.

Once you have entered all of the part-year resident state information for California, then start your New York nonresident state tax return. This will ensure you receive any credits for taxes on income that may be taxed in New Jersey from your New York sourced income.

Finally prepare your New Jersey part-year resident tax return. You should receive a credit for any taxes paid in New York for the income earned while you resided in New Jersey.

**Mark the post that answers your question by clicking on "Mark as Best Answer"