- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You may need to review your form.

You may be holding a different form or the information might be entered in the wrong section of TurboTax which is resulting in the error message.

I recommend reviewing your form to ensure you are entering the correct Form in the correct input section of TurboTax.

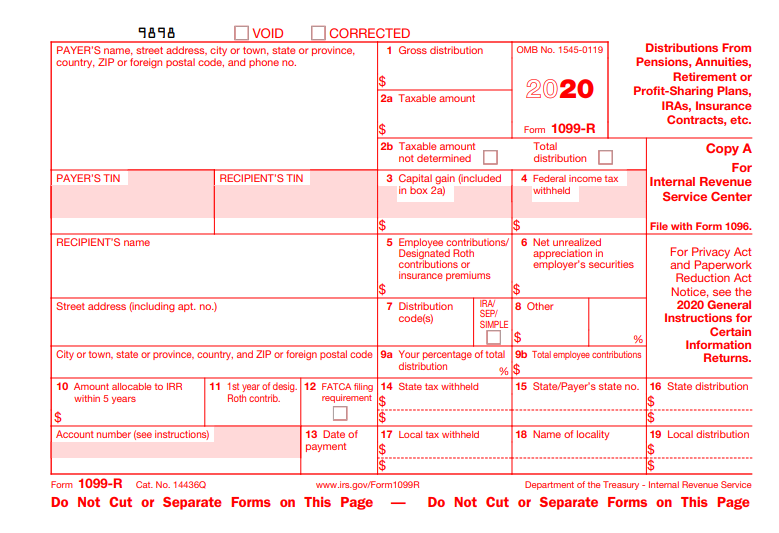

I have attached a blank Form 1099-R. There is only a box 12 for FATCA filing requirements that could be checked. There isn't a box 12a.

Form 1099-R would be reported under Income & Expenses in the section titled Retirement Plans & Social Security.

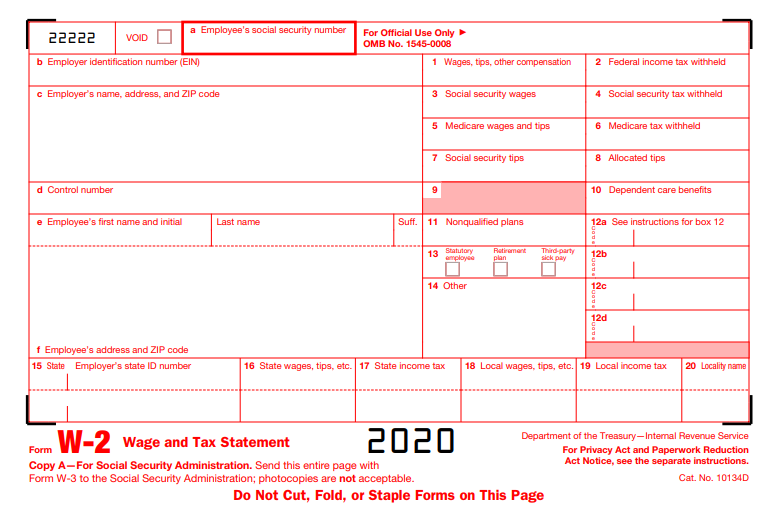

Wages reported on Form W-2 would be reported under Income & Expenses under the section titled Job (W-2).

The forms need to be reported in the correct section to avoid any delays in processing your tax return as well as to ensure they are taxed correctly. It also helps ensure the items reported to the taxing agencies match the items reported on your income tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"