- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

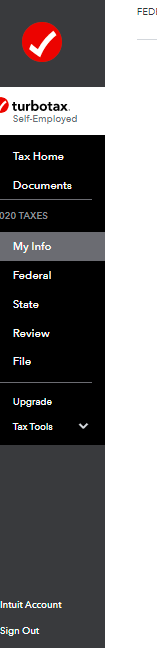

When you begin your Personal Info, you are asked what state you live in. You are also asked if you have income from any other states or if you were a part-year resident of two different states. Off to the left, in the black and gray band, you will see options of what part of the return you would like to access. Under "Federal" is "State".

Did you make money in any other states?

This helps us know if you need to file a state return for this income. Learn more

Here are some examples of what counts as making money in another state:

- Living in one state and working in another

- Owning or inheriting a business, farm or rental property

- Selling a home

- Gambling winnings

February 15, 2021

2:29 PM